● Analyst Stock Sharks recently highlighted an elite group of U.S. companies that have delivered returns on capital exceeding 10% for the past ten years while consistently compounding their invested capital. These businesses represent a rare mix of financial strength, smart capital allocation, and sustainable value creation—qualities that serious long-term investors look for.

● Keeping double-digit capital returns for a decade isn't easy. Companies that pull it off usually have structural advantages like pricing power, strong brands, or cutting-edge technology. But that kind of success attracts competition, which can squeeze margins. There's also the risk that investors get too excited and overpay for future growth that may not materialize.

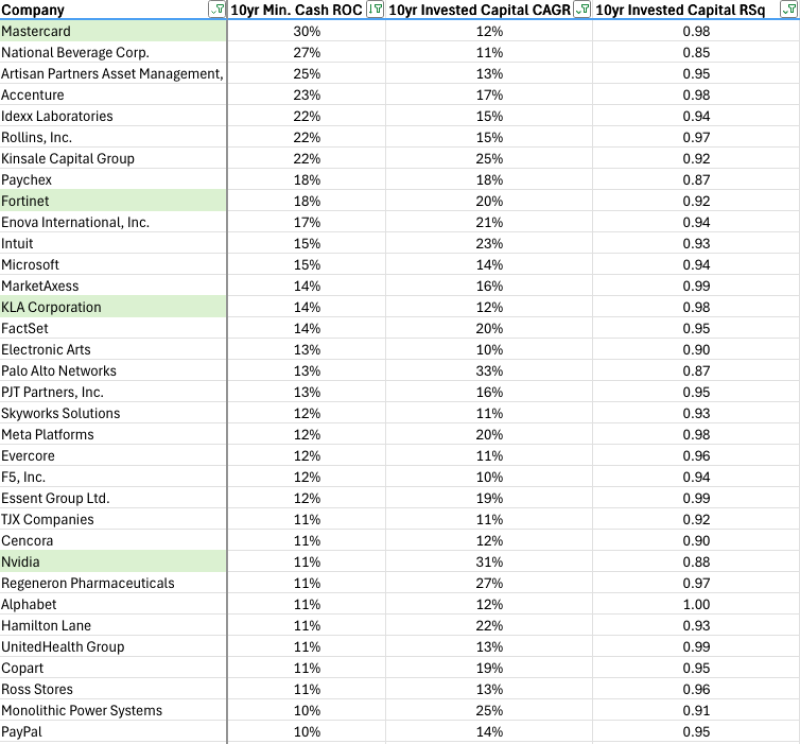

● The data reveals some of the most capital-efficient companies in America. Leaders like Mastercard (30% 10-year ROC), National Beverage (27%), Accenture (23%), and Idexx Laboratories (22%) combine high profitability with smart reinvestment. Growth-focused names like Fortinet, Intuit, and Kinsale Capital have ramped up invested capital by 20–25% annually, proving you can reinvest aggressively without killing returns. Even established players like TJX Companies, UnitedHealth Group, and PayPal have kept their capital efficiency in double digits across multiple economic cycles.

● This list reflects a shift in how top U.S. companies operate. Asset-light models, recurring revenue, and scalable tech have become the blueprint for lasting profitability. Technology, financial services, and healthcare dominate the high-ROC landscape, showing how the economy has moved toward innovation-driven efficiency. These firms don't just deliver for shareholders—they also contribute stable tax revenue and jobs through consistent growth.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah