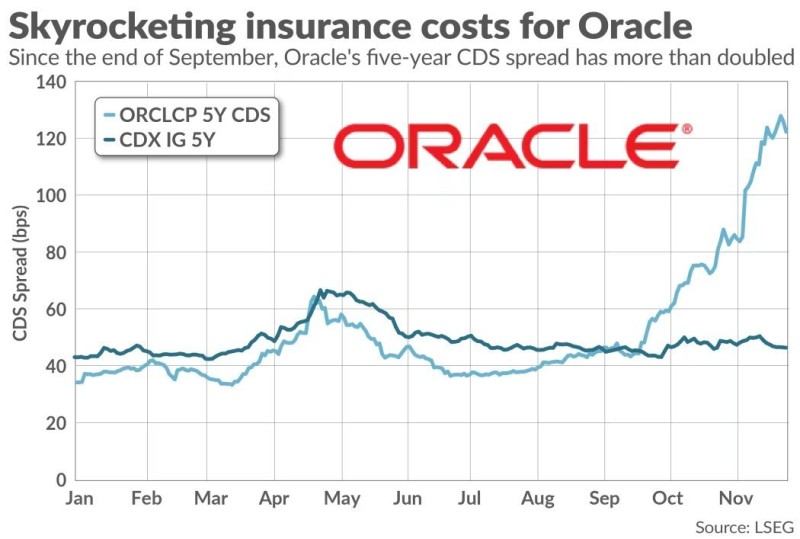

⬤ Oracle (ORCL) is catching heat in credit markets as its default swap spreads hit their highest point all year. The company's five-year CDS spread climbed from roughly 40 basis points earlier in 2024 to above 120 basis points by November—more than tripling in just a few months. That's a serious move, and it's got traders asking whether Oracle's aggressive AI push is starting to stress its balance sheet.

⬤ What makes this stand out is how much Oracle's diverged from the broader market. The CDX IG index—which tracks investment-grade companies—has stayed pretty steady between 45 and 55 basis points. Oracle's spread blowing past 120 shows credit investors are pricing in way more risk for this company specifically. CDS spreads basically tell you how much it costs to insure against default, so when they spike like this, it usually means the market's worried about leverage, cash flow, or how much capital a company's burning through.

⬤ Oracle's timing here is notable. The company's pouring massive resources into AI infrastructure and cloud expansion right when everyone's hyped about the next AI wave. But credit markets might be getting nervous about whether all that spending makes sense long-term. When your CDS spread more than doubles while the broader market stays calm, that's credit investors voting with their wallets—and they're not exactly confident right now.

⬤ This matters because credit signals often show up before equity markets catch on. If Oracle's facing real pressure on its balance sheet, that could ripple through the whole AI infrastructure story. Companies betting big on AI need sustainable funding models, and when insurance costs against your debt triple in a few months, that's a warning sign worth watching. Whether this is just temporary noise or the start of broader credit stress in the AI sector—that's the question traders are trying to answer right now.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov