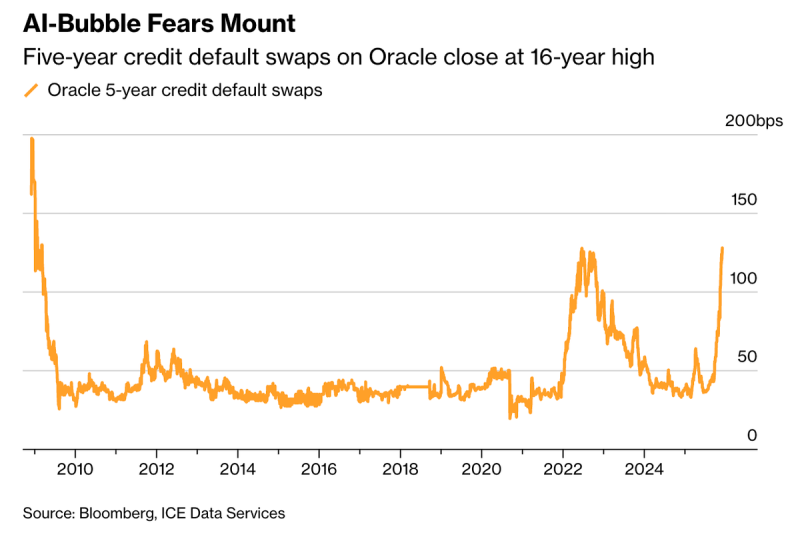

⬤ Oracle (ORCL) is back in the spotlight after its debt-insurance costs jumped to their highest level in over a decade. The company's five-year credit default swaps have climbed to roughly 1.28% per year, reaching levels last seen in 2009. Recent data shows a sharp upward spike in Oracle's CDS during 2024, marking the steepest rise since the financial crisis.

⬤ Oracle's CDS are now more than triple their June level, pointing to a clear shift in how credit markets view the company's risk. Bond investors now see Oracle as one of the riskier large-cap names in the AI sector. The concerns center on its BBB credit rating—the lowest among hyperscalers—and its $100 billion-plus debt load. The firm's aggressive push into AI data centers and power infrastructure, including projects tied to OpenAI/Stargate, has raised questions about whether this leverage-heavy strategy works in today's higher-rate environment.

⬤ The trend shows a long stretch of quiet CDS activity through the 2010s before risk perceptions started climbing in 2022 and then spiking hard in 2024. Credit markets are clearly reacting to Oracle's rapid shift toward capital-intensive AI infrastructure. This also highlights a growing gap between Oracle and its hyperscaler peers, whose debt-insurance costs remain much lower despite similar AI investments. The jump to sixteen-year highs means bond markets are demanding a lot more compensation to insure Oracle debt than at any time since the financial crisis.

⬤ With ORCL reporting Q2 earnings on December 10, the market will be watching for updates on capital spending, AI partnerships, and debt levels. The current CDS spike shows elevated risk concerns around Oracle's strategy at a time when AI-infrastructure spending is reshaping the financial picture for the biggest tech companies.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi