The AI gold rush just got another major player. Oracle made headlines when news broke about a potential $60 billion annual deal with OpenAI, sending shares soaring 25% almost overnight. But here's the catch - Oracle hasn't even built the cloud infrastructure to handle this massive contract yet. Even more concerning? The company is already carrying more debt than almost any other major tech player in the AI space.

The $60 Billion Promise That Shook Wall Street

Market analyst Spencer Hakimian recently highlighted just how wild this situation is: Oracle's stock rocketed 25% based purely on the promise of $60 billion per year from OpenAI for cloud services. The problem is that Oracle still needs to build most of these facilities from scratch. It's essentially betting the farm on AI infrastructure that doesn't fully exist yet, for a client that doesn't currently generate anywhere near $60 billion annually.

This kind of move shows just how desperate tech companies are to get a piece of the AI action. Everyone wants to be the next NVIDIA, but not everyone has the balance sheet to pull it off safely.

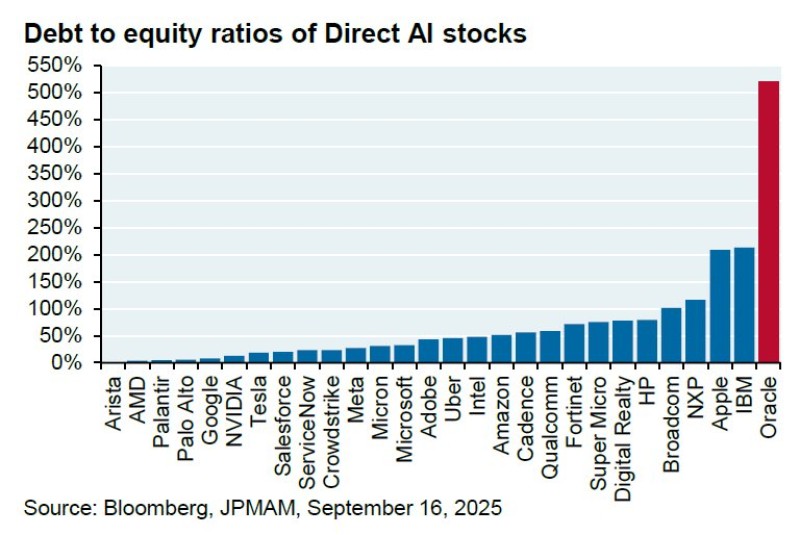

Oracle's Debt Problem Stands Out

Looking at the numbers, Oracle's financial position is pretty concerning. According to recent Bloomberg and JPMorgan data from September 2025, Oracle's debt-to-equity ratio sits above 500% - that's massive compared to other AI players. IBM and Apple are around 200%, while NVIDIA keeps things much more conservative. Oracle is essentially borrowing heavily to fund its AI dreams, which could either pay off big or blow up spectacularly.

Most successful tech companies balance growth with financial discipline. Oracle seems to be throwing caution to the wind, betting that AI demand will justify the massive debt load they're taking on.

The 25% stock jump makes sense when you think about it. OpenAI is still the hottest name in AI, and any partnership with them gets investors excited. Plus, if OpenAI does scale up massively, Oracle would be sitting pretty as their main infrastructure partner. But that's a lot of "ifs" for such a big bet.

The excitement is real, but so are the risks. Oracle needs to actually build the infrastructure, OpenAI needs to grow into that $60 billion revenue figure, and Oracle needs to manage its debt without choking on interest payments. Any one of these could go wrong and tank the whole strategy.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah