The AI infrastructure boom is creating winners and losers, but perhaps no company illustrates the high-stakes nature of this race better than Oracle. While tech giants like Microsoft, Google, and NVIDIA maintain rock-solid balance sheets, Oracle has chosen a radically different path, leveraging its balance sheet to an extent that would make traditional investors nervous.

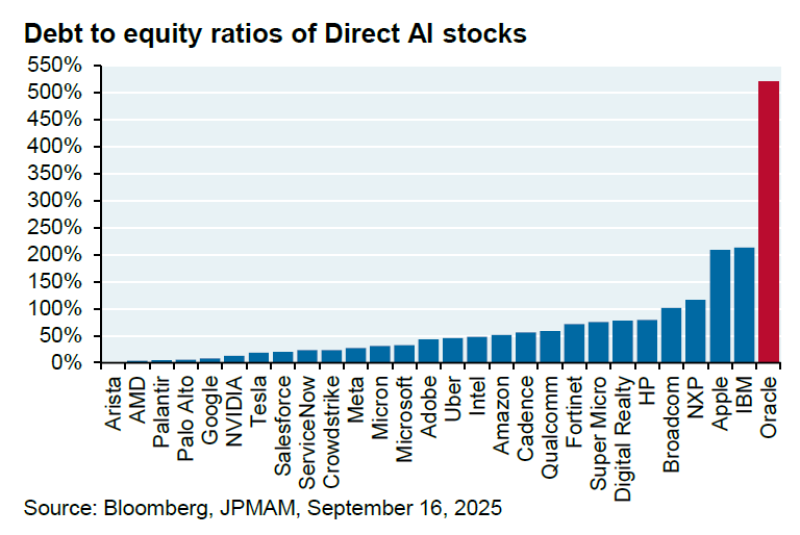

Recent Bloomberg data reveals Oracle's debt-to-equity ratio now exceeds 500%, a figure that stands out dramatically against the conservative financial approaches of its AI-focused peers. This aggressive strategy stems from Oracle's push to capture a larger share of OpenAI's massive $60 billion annual investment commitment, but it's raising serious questions about whether such leverage is sustainable in an industry known for rapid shifts and uncertain returns.

Financial Positioning Across AI Leaders

The contrast in capital structures across major AI players is striking. Oracle leads with a debt-to-equity ratio above 500%, making it a clear outlier in the sector. IBM follows at around 200%, which seems conservative by comparison. Companies like Apple, Broadcom, and HP maintain more moderate leverage between 80-160%, while the true AI powerhouses - Microsoft, Google, NVIDIA, AMD, and Meta - operate with minimal debt, keeping ratios near 0-20%.

This divergence reveals two fundamentally different approaches to AI growth. Most successful AI companies have built their positions through strong cash generation and equity-based expansion, while Oracle is betting that aggressive borrowing will help it catch up in the cloud infrastructure race.

The strategy reflects Oracle's unique position in the market. Unlike Microsoft or Google, which generate massive cash flows from diverse revenue streams, Oracle faces intense pressure to compete against established cloud leaders AWS, Azure, and Google Cloud. The company's leadership clearly believes that aggressive scaling through debt financing represents their best shot at capturing meaningful market share in the AI infrastructure buildout.

Market Response and Risks

Oracle's stock jumped 25% following news of its connection to OpenAI's infrastructure plans, suggesting investors initially embraced the leverage strategy. However, as financial analyst MoneyRadar pointed out, Oracle "doesn't earn that money yet," highlighting the gap between current cash flows and future debt obligations.

This disconnect creates several risks. If AI adoption slows or OpenAI's spending patterns shift, Oracle could find itself servicing heavy debt loads without corresponding revenue growth. The company's aggressive positioning also makes it vulnerable to broader market volatility, particularly if investors begin questioning the sustainability of AI investment levels across the sector.

The broader implications extend beyond Oracle itself. The company's approach could signal a new phase in AI competition where financial leverage becomes a necessary tool for challengers trying to compete with cash-rich incumbents. However, it also demonstrates how the AI arms race is pushing some companies toward potentially unsustainable financial strategies.

Looking Forward

Oracle's debt-fueled AI strategy represents both the promise and peril of the current technology landscape. While the company has successfully positioned itself within OpenAI's massive infrastructure spending, its heavy reliance on borrowing creates unique vulnerabilities that its better-capitalized competitors don't face.

For investors, Oracle's approach offers a clear lesson about the varying risk profiles within AI investments. Companies like Microsoft, Google, and NVIDIA combine AI leadership with balance sheet strength, while Oracle's strategy amplifies both potential rewards and risks. As the AI infrastructure race continues, Oracle's ability to generate sufficient returns to justify its leverage will serve as a crucial test case for debt-driven growth strategies in the technology sector.

Peter Smith

Peter Smith

Peter Smith

Peter Smith