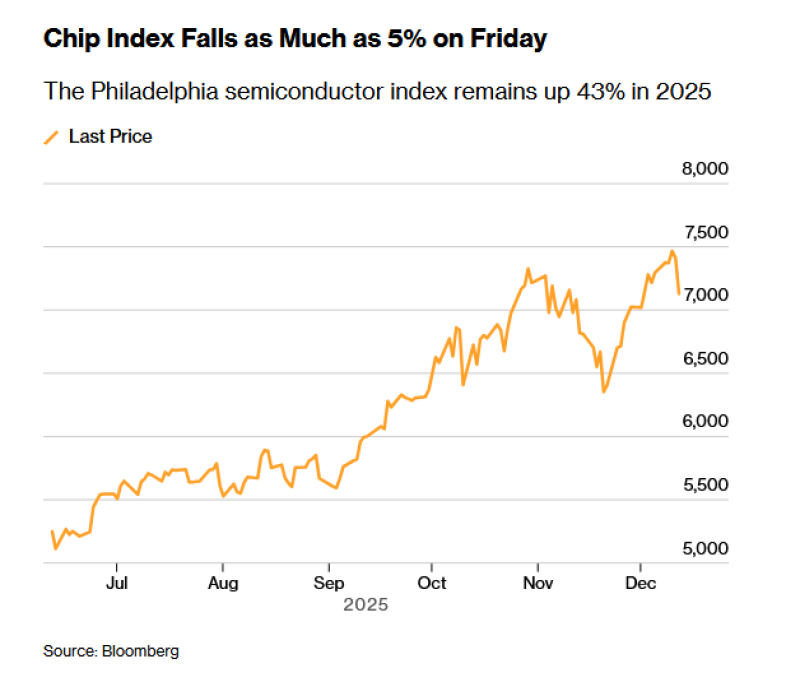

⬤ AI infrastructure and semiconductor stocks took a beating after Oracle announced it's pushing back the completion of an OpenAI-related data center to 2028 instead of 2027. Making matters worse, Broadcom delivered an AI revenue forecast that came in below what the market was hoping for, sparking a widespread retreat across the sector. The Philadelphia Semiconductor Index crashed as much as 5% on Friday—its steepest drop in about two months, based on Bloomberg data.

⬤ The damage spread across major chipmakers and AI-focused companies. Broadcom got hit particularly hard, dropping as much as 12% after the disappointing outlook, while Nvidia (NVDA) slid up to 3.2% during trading. Other companies tied to AI hardware took serious losses too—Astera Labs and Coherent Corp. both fell over 10%, and CoreWeave, a major player in AI cloud infrastructure, dropped around 11%.

⬤ The selloff didn't stay contained to semiconductors. Power and industrial stocks that traders had been betting on as data center plays also moved lower. Constellation Energy, Vistra, GE Vernova, and Cummins all declined alongside chipmakers, showing broader worries that delays in AI infrastructure projects could ripple through to companies supplying electricity generation and equipment.

⬤ Even with Friday's sharp pullback, the semiconductor sector is still crushing it this year. The Philadelphia Semiconductor Index remains up roughly 42% in 2025, easily beating the Nasdaq 100's 20% gain and the S&P 500's 16% climb. The sudden drop just shows how on edge traders are when it comes to high-flying AI and chip stocks—any shift in project timelines or revenue expectations can trigger quick selling after a year of strong gains fueled by optimism around AI infrastructure spending.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi