⬤ Microsoft is ramping up its AI expansion with a massive $10 billion investment in a data center park in Portugal. The project aims to expand cloud capacity and strengthen the company's AI presence across Europe. This move comes as demand for AI computation, model training, and enterprise infrastructure continues to surge. However, European regulators are currently debating tax changes that could impact cross-border investments, including higher digital service levies and stricter reporting rules that may increase compliance costs for tech companies.

⬤ These emerging tax debates could create new challenges for the AI sector, particularly for companies with large-scale, capital-intensive operations. If implemented, higher corporate or digital service taxes might compress profit margins, drive talent migration to lower-tax regions, and potentially force smaller cloud and AI companies out of business. For Microsoft, such policies could significantly alter the economics of long-term projects, especially as Europe becomes increasingly important in the global AI infrastructure race.

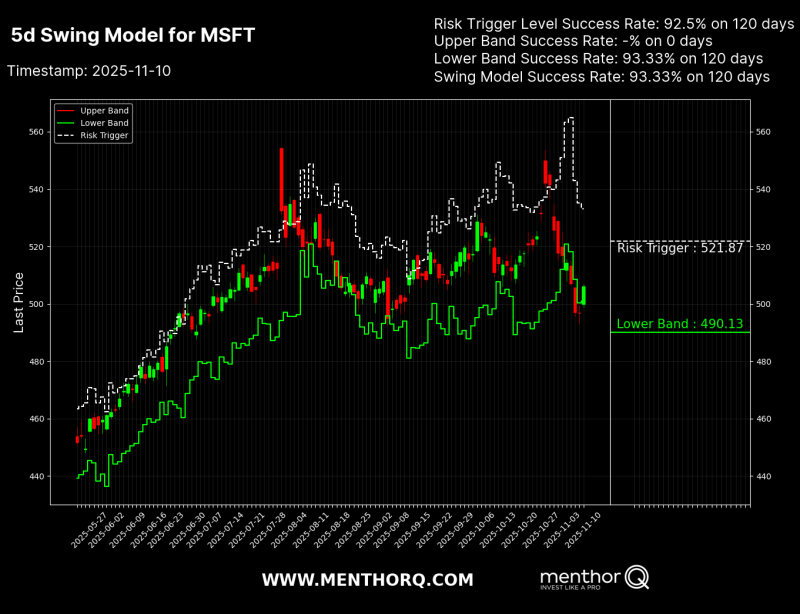

⬤ From a trading perspective, MSFT is showing signs of recovery near the $490 support zone following a recent pullback. Technical analysis indicates the lower support band sits around $490.13, where buyers have been stepping back in. The key resistance level to watch is approximately $522—a breakout above this price point could signal the return of bullish momentum and attract more buyers into the stock.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah