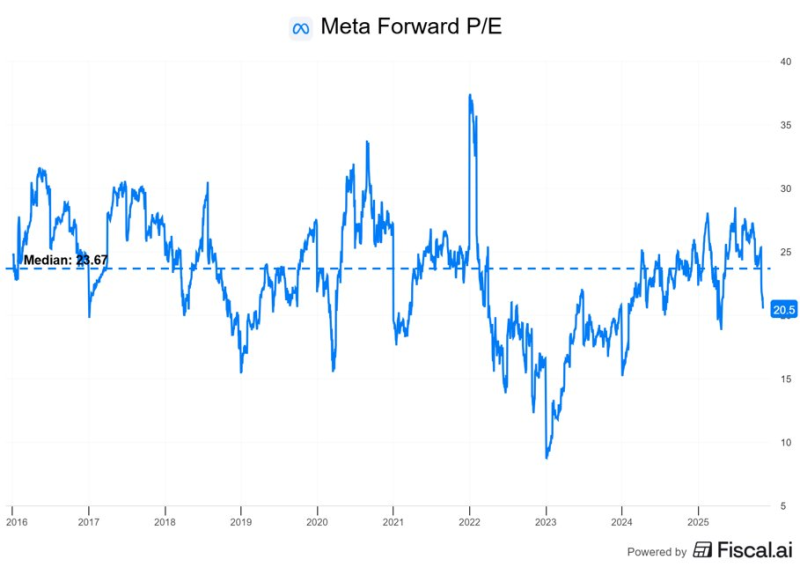

⬤ Meta Platforms (META) caught investors' eyes after a valuation chart showed its forward P/E sitting at roughly 20.5, well below the median line of 23.67. The chart, branded with Fiscal.ai's logo, traces the company's price-to-earnings multiple from 2016 all the way to 2025, making it clear where things stand today versus the historical average. The person who shared it mentioned they've been picking up more $META shares during this recent dip.

⬤ The tweet makes a pretty interesting argument: Wall Street is still pricing Meta as if it's just another advertising company that goes up and down with the economy. But the reality, according to the author, is that META has quietly become "one of the largest AI compute platforms on earth" – and it's all wrapped inside a network where billions of people spend their time every single day. They point out that Meta hits 3.5 billion users daily, Reels is finally making real money, and people are already spending more time on Reels than the classic Facebook Feed. On top of that, AI agents are apparently about to transform each of Meta's apps into powerful tools for discovery and shopping.

⬤ The tweet goes on to say that paying around 20 times forward earnings is way too cheap "for a company compounding like this" – which is exactly why the author keeps buying while everyone else sits on the sidelines. The chart backs up that view, showing the current multiple near 20.5, clearly running under that 23.67 median benchmark.

⬤ When you put it all together – a META forward P/E near 20.5 and all these growth drivers the tweet lays out – you've got an interesting debate brewing about how the market really sees Meta's business. If investors keep thinking of META mainly as an ad company, the valuation will probably stay conservative. But if the AI features and new revenue streams actually take off the way this tweet suggests, people will be watching closely to see if the market's willing to pay up. The chart and the tweet give you a pretty clear picture of where sentiment stands right now and what could move the needle on META's valuation down the road.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova