⬤ The International Monetary Fund just gave the global economy a vote of confidence right before the World Economic Forum kicks off in Davos. The IMF now sees worldwide GDP expanding at 3.3%, a solid bump up from October's 3.1% prediction. What's behind this upgrade? Strong investment momentum, especially the massive capital flowing into artificial intelligence infrastructure and technology.

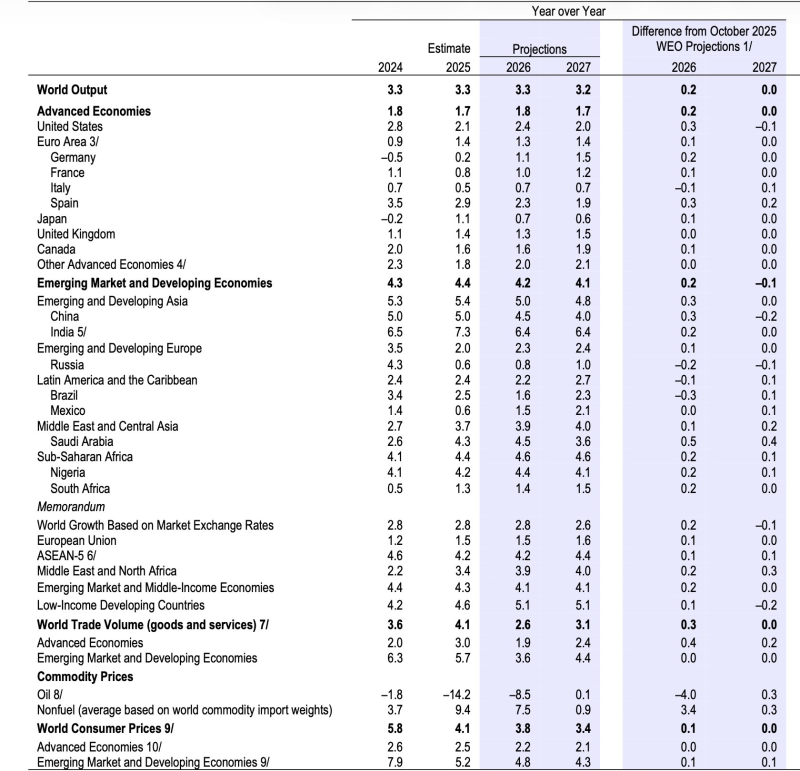

⬤ Looking ahead, global growth stays remarkably consistent through the forecast period. The IMF expects 3.3% growth for both 2025 and 2026, with a slight pullback to 3.2% in 2027. There's a clear split between developed and developing economies—advanced countries are tracking toward 1.8% growth in 2026, while emerging markets should clock in around 4.2%.

The upward revision primarily reflects stronger investment activity, particularly related to artificial intelligence.

⬤ Some major players got meaningful upgrades in this latest round. The U.S. forecast jumped 0.3 percentage points to 2.4%, showing the American economy continues to outperform expectations. Germany's outlook improved by 0.2 points to 1.1%, though that's still fairly sluggish compared to other developed nations. Across the eurozone, France, Italy, and Spain are all projected to grow between 0.7% and 1.2%.

⬤ These revisions matter for markets because they signal better near-term momentum when plenty of investors were worried about slowing growth. The AI investment angle is particularly interesting—it shows new technology is becoming a real economic driver, not just hype. Still, that flat 2027 outlook hints at underlying structural issues that stronger AI spending can't completely fix. Traders should watch how this uneven regional performance plays out across currency markets and international trade flows.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi