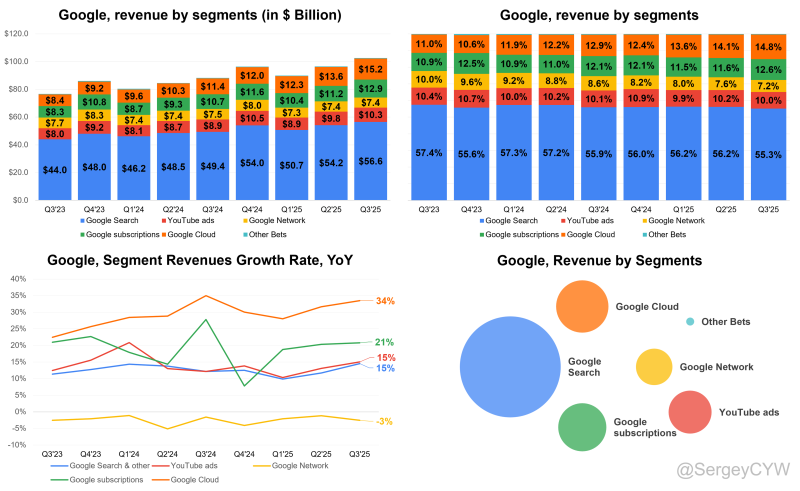

⬤ Alphabet (GOOGL) still leans heavily on Google Search for its bread and butter, but the revenue picture is changing fast. Search pulled in $56.6 billion last quarter—about 55% of total revenue—and grew 14.5% year over year. That's solid, but it's not where the real action is anymore.

⬤ Advertising still pays most of the bills, bringing in $74.2 billion total, but the mix inside that bucket is getting interesting. YouTube Ads added $10.3 billion (roughly 10% of revenue) with 15% growth, while Google Network continued its slide to $7.4 billion, showing the old display network model is fading. Ads account for 72.5% of revenue now, which is still massive, but the company isn't putting all its eggs in that basket like it used to.

⬤ The non-ad businesses are where things get compelling. Google Subscriptions—think YouTube Premium, YouTube TV, Google One—hit $12.9 billion with 20.8% year-over-year growth, making up 12.6% of total revenue. That's recurring, predictable money. But the real star is Google Cloud, which posted $15.2 billion in revenue and grew 33.5% year over year, making it the fastest-growing major segment by a wide margin. Other Bets stayed tiny at $344 million and kept shrinking.

⬤ For investors watching GOOGL, this shift matters. Search still funds the operation, subscriptions give it stability, and Cloud is the growth engine. Alphabet isn't just a search company anymore—it's turning into a more balanced business with multiple revenue streams pulling their weight.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi