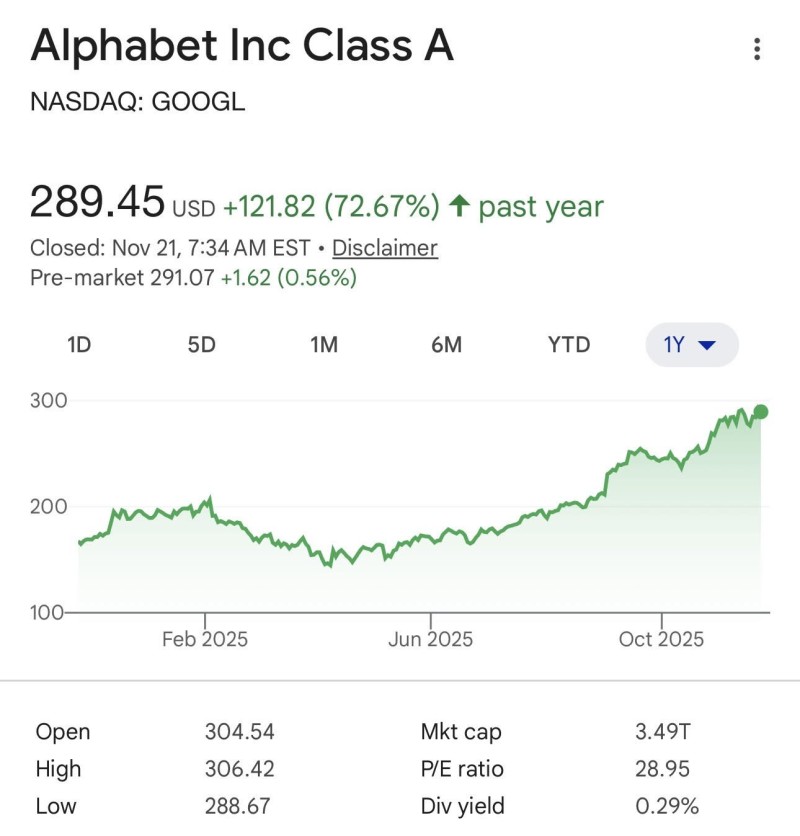

⬤ Alphabet's GOOGL stock has climbed 72.67 percent over the past year, trading around 289 dollars. Recent market chatter highlights how Google's early management calls created a lasting edge in artificial intelligence well before the sector became central to tech valuations. The company secured 40,000 Nvidia NVDA chips before TPU systems went mainstream in 2014 and paired that move with the 400 million dollar DeepMind acquisition—decisions that shaped its early AI trajectory.

⬤ The combination of early GPU accumulation and the DeepMind deal gave Google an unmatched grasp of model training dynamics and infrastructure needs. These moves helped the company spot emerging trends in the digital economy when AI adoption was still in its infancy. The importance of those early steps has come back into focus after a year when some tried to label Google as "GenAI vulnerable," similar to concerns around ADBE. The chart shows GOOGL has sustained a strong upward trend throughout 2025, backed by broader recognition of its long-standing AI capabilities.

⬤ The stock data reflects steady momentum, with GOOGL hitting highs above 306 dollars during recent sessions and holding a near-record trading range. Alphabet now carries a market cap of roughly 3.49 trillion dollars and trades at a price-to-earnings ratio of 28.95, showing how the market values its role in AI-driven infrastructure and software. The stock's rise lines up with the narrative that Google's early infrastructure bets positioned it ahead of rivals in understanding training requirements, scaling needs, and long-term computational demands.

⬤ This renewed focus on Google's early strategy matters because it shows how long-term management decisions can shape competitive positioning as technology cycles shift. The alignment of early hardware investments with foundational AI research gave GOOGL a head start in developing scalable systems that remain critical today. As AI continues to influence the direction of major enterprise technologies, companies with deep experience and established infrastructure may play a defining role in the next phase of market leadership.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi