Amazon Web Services might be entering its biggest growth phase in years, and it's all thanks to Anthropic's appetite for compute power. Tech analyst Oguz O. | 𝕏 Capitalist recently highlighted that two gigawatt-scale clusters coming online could inject up to $20 billion into AWS's cloud revenue - a watershed moment reminiscent of Oracle's transformative OpenAI partnership. This isn't just incremental growth. It's a potential game-changer for Amazon's cloud division.

The Growth Trajectory Tells the Story

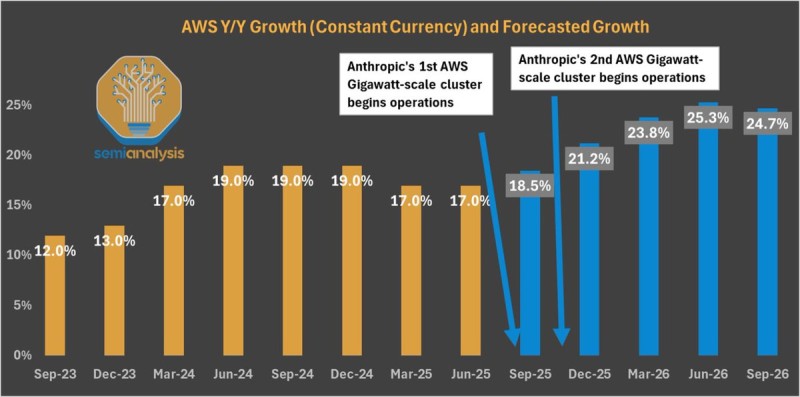

SemiAnalysis data shows AWS hitting a rough patch in late 2023, with growth sliding into the low teens. The forecast through 2024 and early 2025 suggests a modest stabilization around 17-19%. But September 2025 marks the turning point. That's when Anthropic's first gigawatt cluster fires up, followed by another in mid-2026. Analysts expect growth to surge past 25% by then - numbers AWS hasn't posted in years.

Why Gigawatt Clusters Matter

Running cutting-edge AI models isn't like hosting websites. These systems consume electricity on the scale of entire cities, measured in gigawatts rather than megawatts. Anthropic's clusters cement AWS as the infrastructure backbone for one of AI's fastest-growing companies. The strategic payoff is threefold: massive revenue directly tied to AI demand, positioning AWS to compete head-to-head with Microsoft Azure and Google Cloud in the generative AI race, and operational leverage that comes from managing power-hungry workloads at scale.

The Oracle Comparison Everyone's Making

Oracle's deal to supply 4.5 gigawatts to OpenAI starting in 2027 was a defining moment for its cloud business. AWS's Anthropic partnership carries similar weight, but with a crucial difference. While Oracle is betting big on a handful of marquee clients, AWS is spreading its infrastructure across multiple leading AI labs. Anthropic just happens to be one of the largest, and that diversification could prove more durable over time.

What It Means for Investors

If these projections pan out, AWS could be heading into one of its strongest periods since the pandemic boom. For Amazon shareholders, that means more than just revenue growth. It's validation that the company's AI strategy isn't just hype - it's starting to generate real, measurable returns. The cloud business has always been Amazon's profit engine. Now it's getting rocket fuel.

Usman Salis

Usman Salis

Usman Salis

Usman Salis