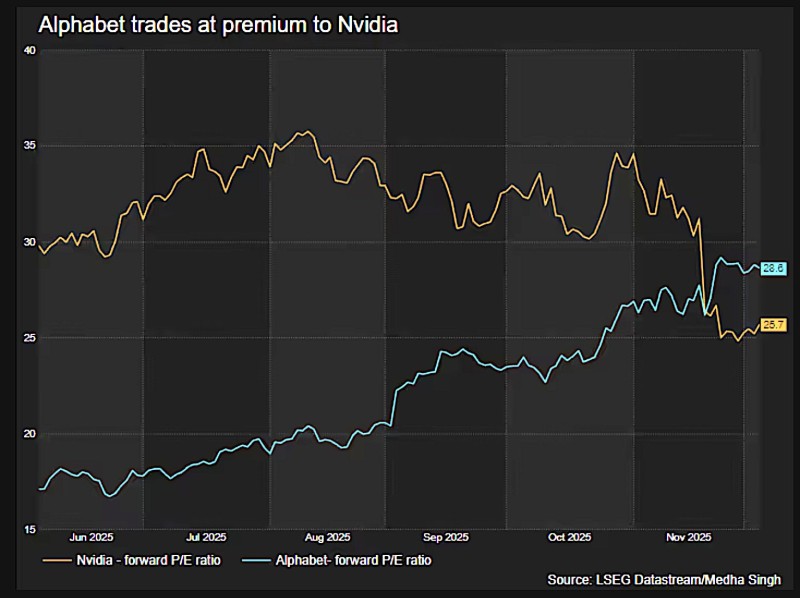

⬤ Alphabet (GOOGL) now trades at a higher valuation multiple than Nvidia (NVDA), signaling changing investor priorities in AI. Alphabet shares climbed more than 30% during Q4, lifting market cap to $3.88 trillion and pushing its forward P/E to 28.6 versus Nvidia's 25.7. The LSEG chart shows Alphabet's valuation line shooting up while Nvidia's gradually compressed through late 2025.

⬤ Alphabet's forward P/E rose steadily from around 20 in mid-year to nearly 29 by November. Meanwhile, Nvidia dropped from a 35+ forward P/E earlier in 2025 down to 25.7. The reversal reflects shifting expectations across AI markets. Alphabet's cloud expansion, AI-powered search, and generative AI rollout triggered a sharp stock re-rating. Nvidia still benefits from chip demand but is seeing its multiple normalize as growth rates level off after several monster quarters. Fresh AI news highlights that Alphabet’s momentum continues to build, with GOOGL stock up 66% YTD as the company deepens its AI integration across products and cloud infrastructure.

⬤ For most of 2025, Nvidia held a commanding earnings multiple premium over Alphabet. That premium flipped in late October and November when Nvidia's forward P/E dropped while Alphabet's kept climbing. The crossover matches growing enthusiasm around Alphabet's AI infrastructure and software execution, which markets now view as more sustainable for long-term earnings growth.

⬤ The valuation leadership swap between Alphabet and Nvidia matters for the entire AI sector. It shows investors may now favor scalable platform AI monetization over pure hardware plays. As money flows adjust to this thinking, Alphabet's re-rating versus Nvidia could shift broader sector sentiment and reshape how competitors position themselves across the AI landscape.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi