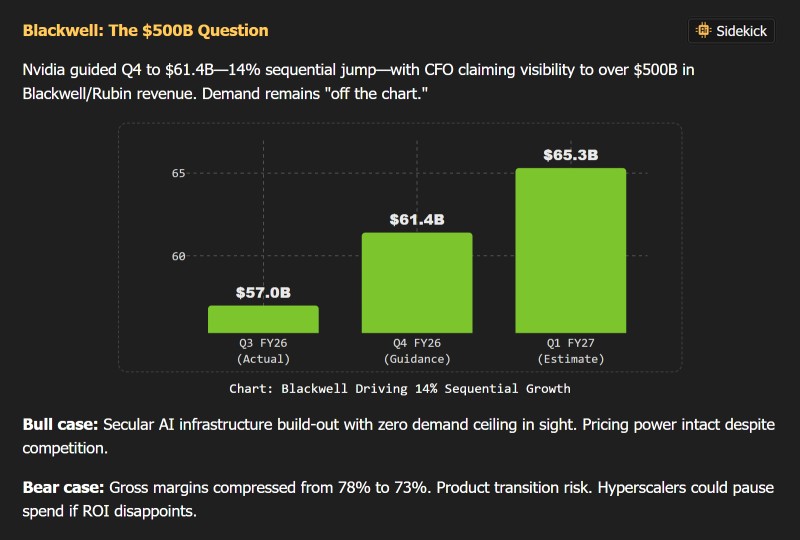

⬤ Nvidia just bumped up its revenue expectations for the coming quarter, cementing its spot at the heart of the AI infrastructure boom. The company revealed that demand for its next-generation Blackwell and Rubin platforms is exceptionally strong, giving them a clear line of sight to a potential five-hundred-billion-dollar AI demand pipeline. Q4 fiscal 2026 guidance now sits at 61.4 billion dollars—a 14 percent jump from the previous quarter.

⬤ The numbers tell the story: Nvidia's moving from 57.0 billion dollars in Q3 fiscal 2026 to the guided 61.4 billion dollars in Q4, with projections hitting 65.3 billion dollars in Q1 fiscal 2027. The company's calling AI-related demand "off the chart," driven by massive system deployments and hyperscalers racing to boost their model training and inference capabilities. This visibility into future demand shows just how much momentum Blackwell adoption has behind it.

⬤ The market's split on what comes next. Bulls are pointing to rising AI capital spending, a seemingly endless infrastructure build-out, and Nvidia's pricing power holding firm. Bears are watching margins compress from 78 percent to 73 percent and questioning whether cloud providers will keep spending if AI infrastructure doesn't deliver the returns they're banking on.

⬤ Nvidia's still the most influential player in the AI supply chain as global demand expands. The stronger guidance and substantial pipeline reinforce the company's role in shaping AI infrastructure's next chapter, though questions around margins, competition, and long-term spending patterns remain open.

Peter Smith

Peter Smith

Peter Smith

Peter Smith