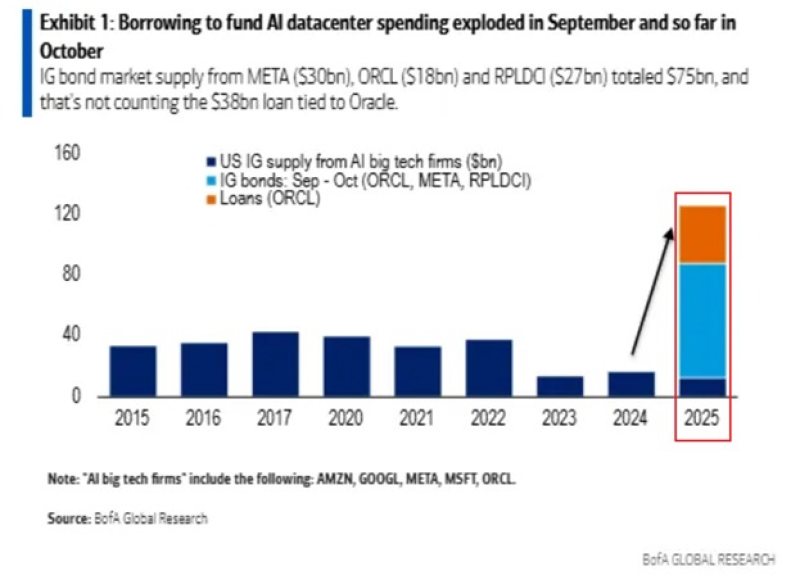

Here's something that should make everyone sit up and take notice: the biggest tech companies in the world just went on a borrowing binge like we've never seen before. We're talking about $126 billion in new debt, all in the name of building AI data centers. Recent market data from BofA Global Research confirms that 2025 has marked a structural break in how aggressively Big Tech is funding the AI arms race.

The Numbers Are Staggering

Investment-grade bond issuance from major AI companies has hit a record $88 billion, with Meta leading at $30 billion and Oracle adding $18 billion during September and October. Then came the really big deals: Meta and Blue Owl Capital secured $27 billion for a Louisiana AI data center, while Oracle locked in $38 billion for facilities in Texas and Wisconsin. Total borrowing: $126 billion.

Here's the context: from 2015 through 2024, annual issuance from these companies averaged just $32 billion per year. The 2025 figure represents a 500% jump over 2024—an unprecedented scale that changes everything.

Why the Massive Spending Spree?

Here's what's driving all this borrowing:

- AI data centers need enormous upfront investment in compute clusters, advanced cooling systems, real estate, fiber networks, and power infrastructure

- Generative AI models are scaling from billions to trillions of parameters, creating compute demand that grows faster than traditional cash flow can support

- Companies like Meta and Oracle are turning to bond markets and private financing to stay competitive in the AI arms race

- Fierce competition among Amazon, Google, Microsoft, and other major players is amplifying the urgency to build now and worry about costs later

What This Actually Means

This debt explosion signals we've entered a completely new phase of AI development—one defined by industrial-scale infrastructure buildouts. But here's the thing: while investors seem comfortable financing these expansions now, $126 billion in new debt will reshape corporate balance sheets for years. These companies are betting that AI will generate enough revenue to justify the investment, but that remains an open question.

AI has also stopped being just a technology story. It's now fundamentally tied to capital markets, energy planning, and national competitiveness. The scale of these investments affects credit markets and raises questions about power grid capacity.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov