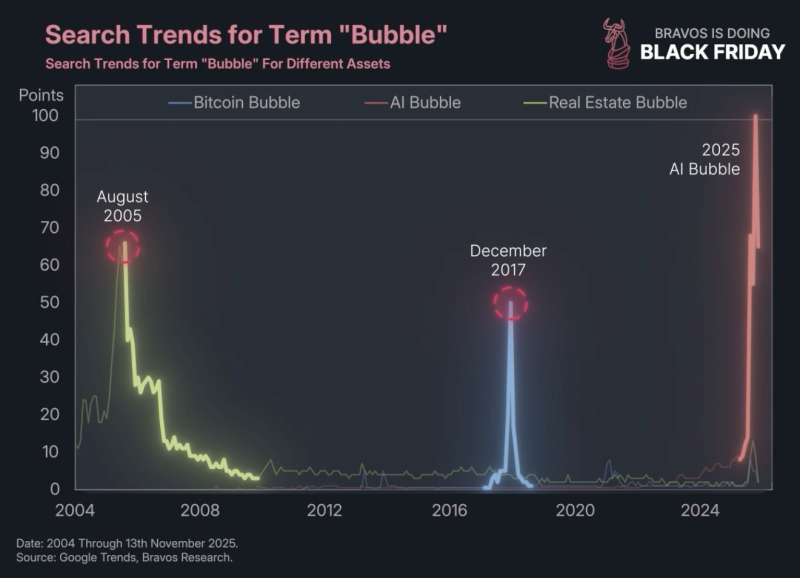

⬤ The number of Google searches for “AI bubble” has risen sharply in recent months and has reached a record high. The surge began right after Michael Burry disclosed that he has taken two large short positions in AI-related companies. Because Burry correctly forecast the 2008 housing crash, his new bets have unsettled many people. A chart of search interest shows that AI-bubble queries in 2025 have jumped almost to the top of the scale.

⬤ Earlier periods also produced bursts of bubble related searches - yet none match the current AI spike. Searches for “real-estate bubble” peaked in August 2005, shortly before house prices collapsed. Searches for “Bitcoin bubble” spiked in December 2017 during crypto's rapid ascent. Both of those earlier spikes were sharp and brief. The 2025 AI-bubble line, by contrast, climbs higher and persists longer than any previous wave.

The rise follows Michael Burry's disclosure of two large short positions that target the AI sector, a step that commentators compare to the warnings he issued before the 2008 Financial Crisis.

⬤ The data cover the years 2004 through November 2025. For most of that stretch, bubble related searches remained low. In 2025 concern about AI has suddenly surged. This abrupt jump indicates that ordinary investors now fear AI share prices have risen too far, too fast. Burry's wagers have led many to ask whether the market faces another severe correction.

⬤ The search volume matters because it reveals what the public already worries about, often before prices respond. When millions type “AI bubble” into Google, the action shows real concern that valuations have become excessive and that a crash could follow. As this fear spreads, volatility may increase and investors may question whether AI's rapid gains will continue.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah