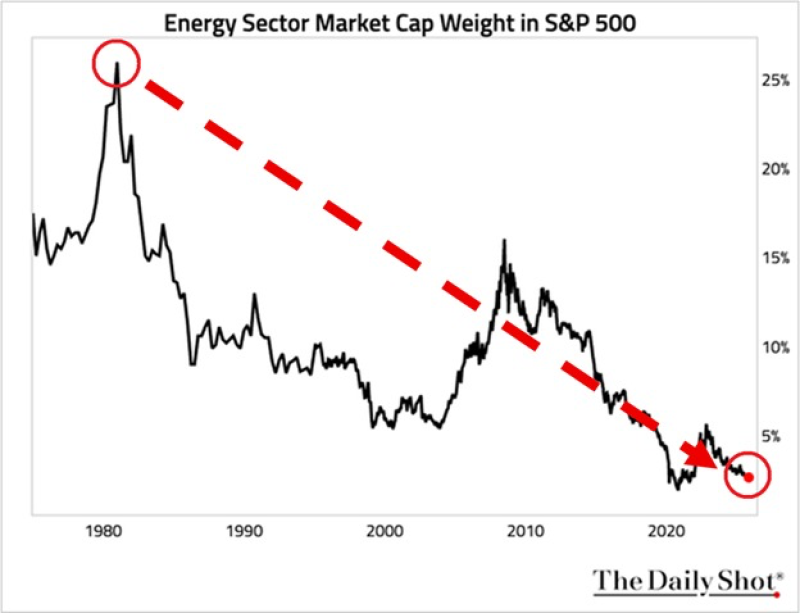

The U.S. stock market is going through one of its most dramatic transformations ever. After decades of steady decline, the energy sector now makes up just 2.6% of the S&P 500—one of the lowest readings in history. Meanwhile, the AI boom has pushed tech companies to unprecedented dominance, with Nvidia alone now representing more than three times the entire energy sector's weight.

From Dominance to Irrelevance: Four Decades of Decline

Back in the early 1980s, energy companies controlled roughly 26% of the S&P 500. High oil prices, geopolitical tensions, and America's heavy industrial base made energy the market's undisputed leader. But that position has eroded dramatically over the past forty years.

The decline wasn't smooth—there were brief recoveries in the late 1980s, during the mid-2000s oil supercycle, and again in 2021's commodity rebound. But each rally was followed by an even steeper drop. Since the 2008 financial crisis alone, energy's market weight has fallen by more than 13 percentage points.

Why Energy Lost Its Grip

The collapse reflects fundamental changes in how the American economy works. The shift toward technology and services meant less dependence on physical resources. Companies figured out how to do more with less fuel. ESG investing pushed capital away from fossil fuels. And the sector's notorious boom-and-bust cycles made it increasingly unattractive to long-term investors. Even when oil prices spiked, energy stocks couldn't regain their former status.

The Nvidia Comparison

Here's the starkest illustration of this shift: Nvidia now represents about 8.5% of the S&P 500, while the entire energy sector—all 22 companies combined—sits at just 2.6%. One semiconductor company has become more valuable than an entire economic sector that once powered America's growth. This isn't just a shift in market leadership; it's a complete reordering of economic priorities.

What This Means for Markets

- The decline is structural, not temporary: Even during periods of high oil prices, energy couldn't regain meaningful ground in the index

- Tech absorbed energy's former dominance: The S&P 500 today revolves around computational power, data infrastructure, AI, and software—not physical commodities

- AI accelerated the divergence: Nvidia's explosive growth created one of the largest single-stock concentrations in the index's history

- Energy's future may depend on AI: Ironically, the sector's revival could come from powering the very technology that displaced it

Could AI Revive Energy?

There's an interesting twist developing. AI data centers consume massive amounts of electricity—far more than traditional computing. This creates real opportunities for utilities, natural gas producers, and energy infrastructure companies. AI is also helping oil and gas firms cut costs and boost efficiency. The industrial-scale compute that powers modern AI still depends heavily on natural gas in the U.S.

But the headwinds remain strong. Renewable energy adoption continues accelerating. Policy pressure on fossil fuels persists. And ESG trends have weakened the capital base for many traditional energy companies. Whether AI-driven power demand can overcome these obstacles remains an open question.

A Market at a Crossroads

The American stock market has fundamentally changed. Energy has fallen from 26% of the S&P 500 to just 2.6%, while a single AI chip company has grown to more than triple that size. Whether next-generation data centers and AI infrastructure will bring energy back into relevance is still uncertain. But the AI revolution isn't just transforming technology anymore—it's reshaping the entire structure of American markets, and the energy sector is caught right in the middle of it.

Peter Smith

Peter Smith

Peter Smith

Peter Smith