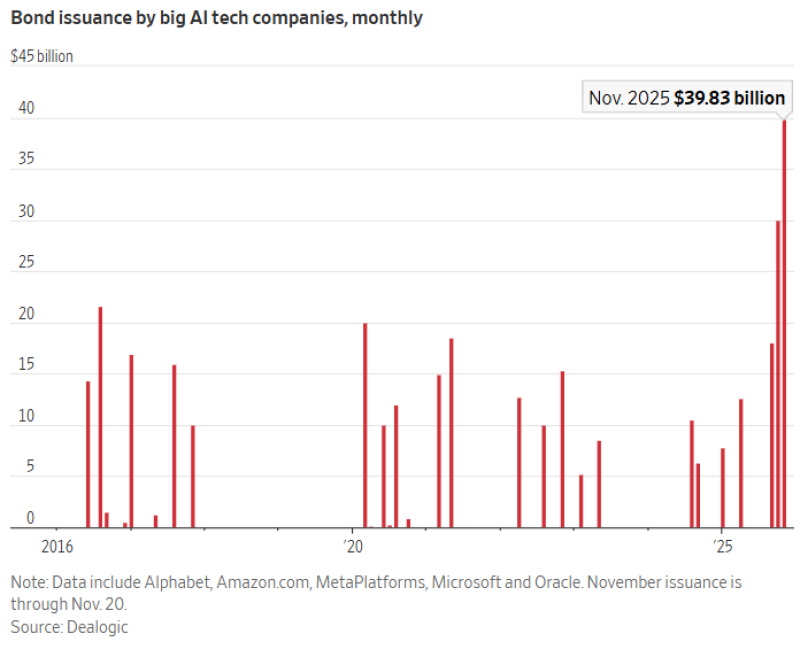

⬤ Here's the thing: AI hyperscalers like Google, Amazon, Meta Platforms, Microsoft, and Oracle are borrowing money at a pace we haven't seen before. Over the last three months, these companies raised $88 billion in new debt. To put that in perspective, they only borrowed $66 billion during the entire three years before that. November 2025 alone saw $39.83 billion in bond issuance—a record-breaking month that shows just how urgent their capital needs have become.

⬤ Let's be real—this isn't normal behavior for tech companies. For years, monthly bond issuance by Alphabet ($GOOGL), Amazon ($AMZN), Meta ($META), Microsoft ($MSFT), and Oracle ($ORCL) typically stayed under $20 billion. But the AI race has changed everything. These companies are now pouring cash into data centers, semiconductors, power infrastructure, and cloud expansion to keep up with massive AI workloads. They're essentially front-loading their investments to lock in supply chains and secure long-term computing capacity.

⬤ Now, some might worry about rising debt levels, but these aren't struggling companies. Each one has strong cash flow and easy access to credit markets with favorable terms. For them, taking on debt is a strategic move—a way to fund enormous investment cycles without draining their reserves. It's a calculated bet that AI infrastructure will pay off big in the coming years.

⬤ The $88 billion borrowing spree tells you everything about where the tech sector is headed. AI isn't just a buzzword anymore—it's driving real capital deployment at a scale that dwarfs previous years. As these companies continue ramping up spending, expect this trend to reshape competitive positioning across the entire technology landscape.

Usman Salis

Usman Salis

Usman Salis

Usman Salis