● According to analysis shared by Qualtrim, Wells Fargo predicts the global cloud computing market will explode from $230 billion in 2024 to $873 billion by 2029, marking a 31% compound annual growth rate. Industry data highlights unprecedented expansion driven by hyperscale giants Oracle (ORCL), Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL)—all reporting massive cloud backlogs and commitments extending through mid-2025.

● This growth story comes with real stakes. As providers sink billions into data centers, renewable energy, and AI infrastructure, analysts point to potential pitfalls: overcapacity, market consolidation, and rising capital costs. Success also hinges on favorable tax policies and regulatory frameworks, as governments weigh data sovereignty against incentives for private cloud investment. Regulatory shifts or tighter fiscal conditions could easily slow deployment and squeeze smaller players out.

● Financially, the cloud boom means huge revenue opportunities and serious fiscal questions. A smart approach might involve profit-based taxation on hyperscalers that ensures fair contributions without stifling innovation. Meanwhile, demand from AI workloads, enterprise digitization, and cybersecurity keeps cloud computing at the center of global IT spending for the next five years.

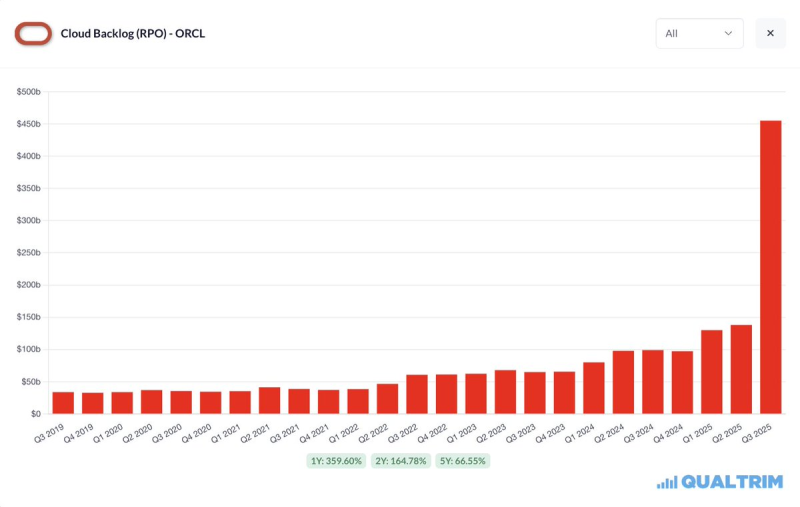

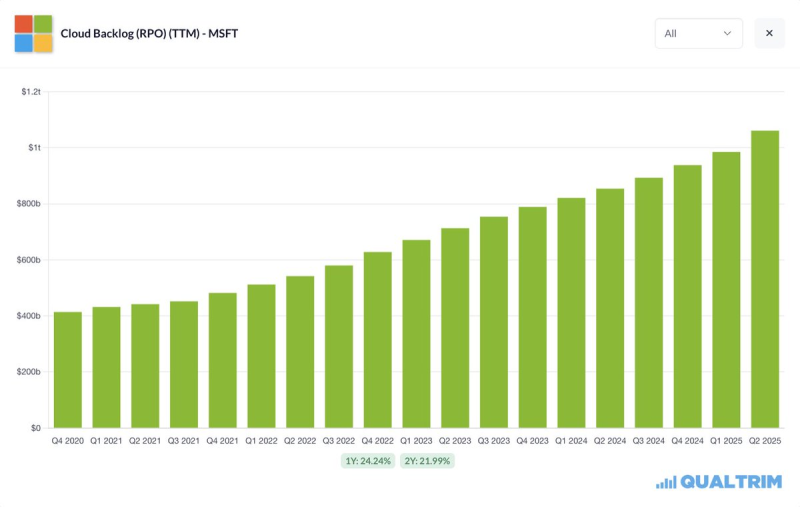

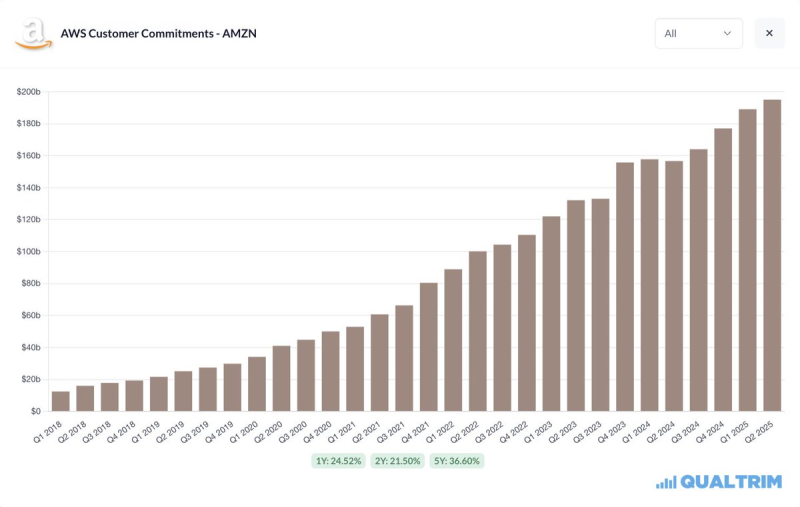

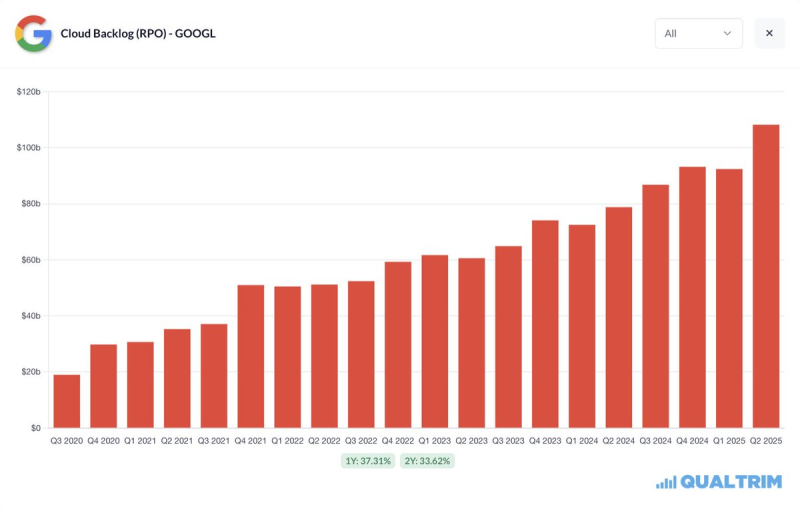

● The numbers tell a striking story. Oracle's cloud backlog has rocketed 359% year-over-year to nearly $450 billion. Microsoft's backlog topped $1.1 trillion, up 24%. Amazon Web Services hit $190 billion in customer commitments, while Google Cloud surged past $100 billion, up 37%.

Peter Smith

Peter Smith

Peter Smith

Peter Smith