America's wealth divide has grown to unprecedented levels. New Federal Reserve data shows that the top 10% of households now own 87% of all stocks, while the remaining 90% share just 13%. This concentration of asset ownership has become the defining characteristic of economic inequality in the modern era, with the top 1% alone controlling roughly half of all stock market wealth.

The Top 10% Dominate U.S. Wealth

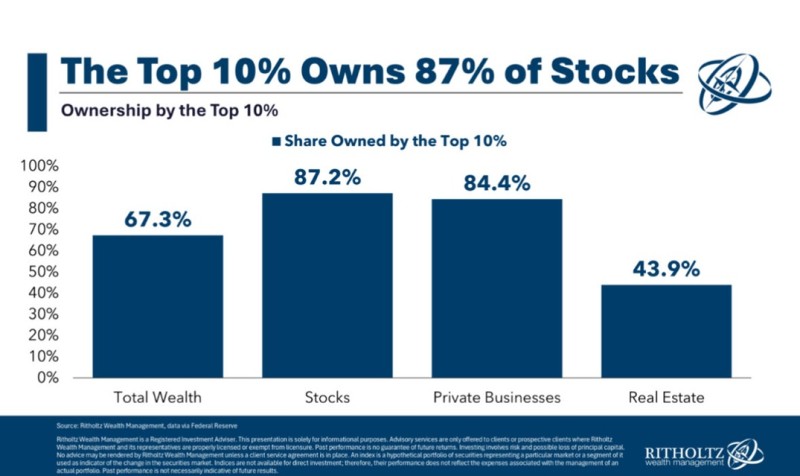

Analysis by The Kobeissi Letter based on Federal Reserve data reveals how concentrated wealth has become across different asset types.

The top 10% own 87.2% of all stocks, control 84.4% of private businesses, hold 43.9% of real estate, and possess 67.3% of total U.S. net worth. This means two-thirds of all American wealth is concentrated among the richest families, while the bottom half collectively holds only a small fraction of total assets.

Why the Gap Keeps Growing

Several forces have driven this inequality over the past decade. Stock markets have grown much faster than wages, rewarding households already invested in financial assets. About half of U.S. households own no stocks at all, missing out on post-pandemic market gains. The rise of tech giants like Nvidia, Apple, and Microsoft has inflated portfolios for wealthy investors who already hold large stakes. Meanwhile, rising home prices have enriched existing homeowners while high mortgage rates and low supply lock out first-time buyers. The result is a system where wealth accumulation depends on market participation rather than earned income.

A Troubling Reality

The bottom 50% of Americans hold just 1% of all equities, effectively excluding them from the nation's economic gains. This imbalance has sparked debate around taxation, monetary policy, and whether such concentrated ownership can be sustained long-term. Economists warn that extreme inequality could eventually slow consumption and increase financial instability.

The Prosperity Divide

U.S. prosperity is increasingly tied to asset ownership rather than wages. As inflation erodes purchasing power and markets consolidate around a few dominant companies, the gap between investors and wage earners continues to widen. While stock markets hit record highs, wealth distribution tells a different story. Economic growth alone doesn't guarantee shared prosperity—it amplifies the advantages of those who already own the assets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis