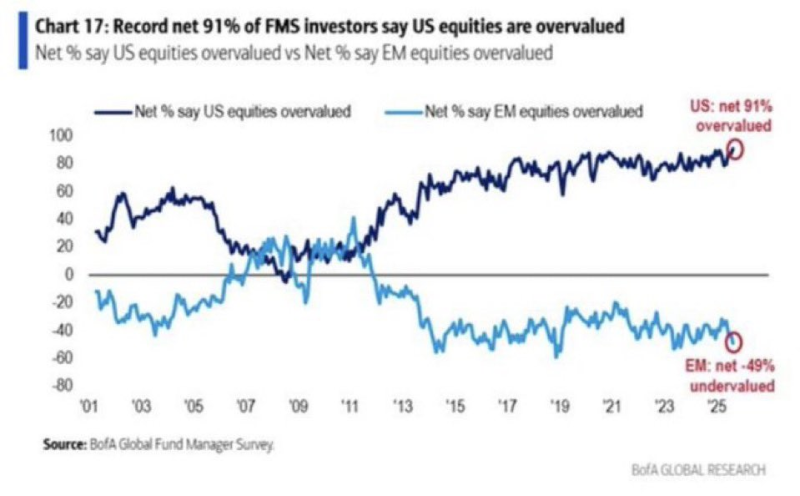

Global investors are raising concerns about U.S. stock valuations. Bank of America's latest Global Fund Manager Survey reveals that a record net 91% of fund managers consider U.S. stocks overvalued—the highest level ever recorded. Meanwhile, a net 49% view emerging market equities as undervalued, creating the widest sentiment gap between these asset classes in decades.

Key Findings

This unprecedented divergence, highlighted by Barchart, marks a critical moment for global markets as investors balance U.S. market strength against cheaper opportunities elsewhere.

- U.S. Equities: Over the past two decades, fund managers have frequently flagged U.S. stocks as expensive, but the current 91% net overvaluation consensus shatters all previous records, surpassing earlier peaks from 2020 and 2021.

- Emerging Markets: EM equities have dropped to one of their most undervalued readings in modern history. The net -49% reading suggests investors see significant opportunities in regions like Asia and Latin America.

- Historical Context: Since 2010, U.S. valuations have consistently stayed above the global average while EM valuations remained depressed. Today's extreme divergence represents the sharpest sentiment gap on record.

Why This Matters

Several factors are driving the overvaluation narrative. S&P 500 price-to-earnings multiples remain near two-decade highs, with mega-cap tech stocks like NVDA, MSFT, and GOOG fueling much of the rally and raising bubble concerns. Federal Reserve policy uncertainty adds another layer of complexity—while rate cuts are expected later in 2025, persistent inflation risks could keep monetary conditions tighter than anticipated. Meanwhile, emerging market economies such as India and parts of Latin America are gaining momentum, making their cheaper valuations increasingly attractive to investors looking for growth opportunities.

What It Means for Investors

This extreme sentiment reading could trigger a rotation as institutional money shifts toward EM equities through funds like EEM and VWO if U.S. valuations stay stretched. History shows that when consensus reaches such extremes, markets often experience heightened volatility or corrections as positioning unwinds. Still, U.S. equities have historically maintained a valuation premium thanks to innovation, deep liquidity, and strong corporate governance standards.

Peter Smith

Peter Smith

Peter Smith

Peter Smith