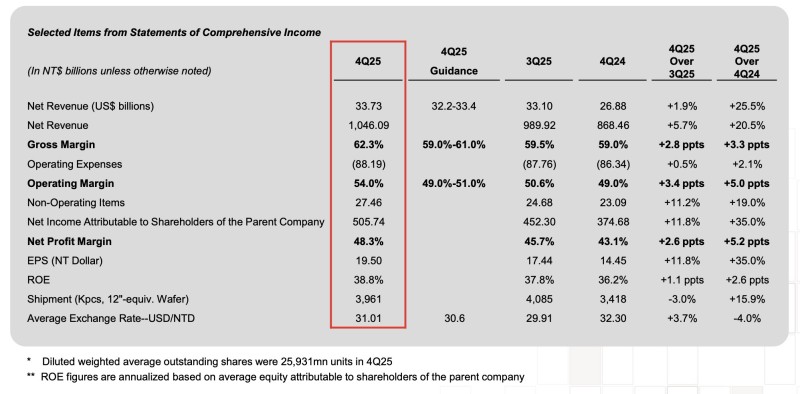

⬤ TSMC (TSM) just dropped some seriously impressive numbers for Q4 2025, crushing market expectations with margins that have analysts doing double-takes. The company posted a stunning 62.3% gross margin and 54% operating margin—numbers that prove all the earlier skepticism about their ability to maintain profitability was completely off base. Despite global economic headwinds and uncertainty swirling around the semiconductor space, TSMC showed why they're the undisputed heavyweight champion of chip manufacturing.

⬤ The outlook for Q1 2026 looks equally strong. TSMC is guiding for revenue between $34.6 billion and $35.8 billion, with gross margins expected to land between 63-65% and operating margins in the 54-56% range. These aren't just solid numbers—they're proof that TSMC can keep printing money while the rest of the industry struggles with pricing pressure and demand volatility.

⬤ What makes these results really stand out is TSMC's ability to dominate while everyone else is fighting for scraps. The company's leadership in advanced chip manufacturing—especially for AI, 5G, and high-performance computing—gives them pricing power that competitors can only dream about. They're not just surviving the macro challenges; they're thriving through them.

⬤ For the broader semiconductor industry, TSMC's performance sets the tone. When the world's largest contract chipmaker posts results this strong and guides confidently for the next quarter, it sends a clear signal that demand for cutting-edge chips remains robust. This should lift sentiment across the entire sector and reinforce expectations for continued growth in 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah