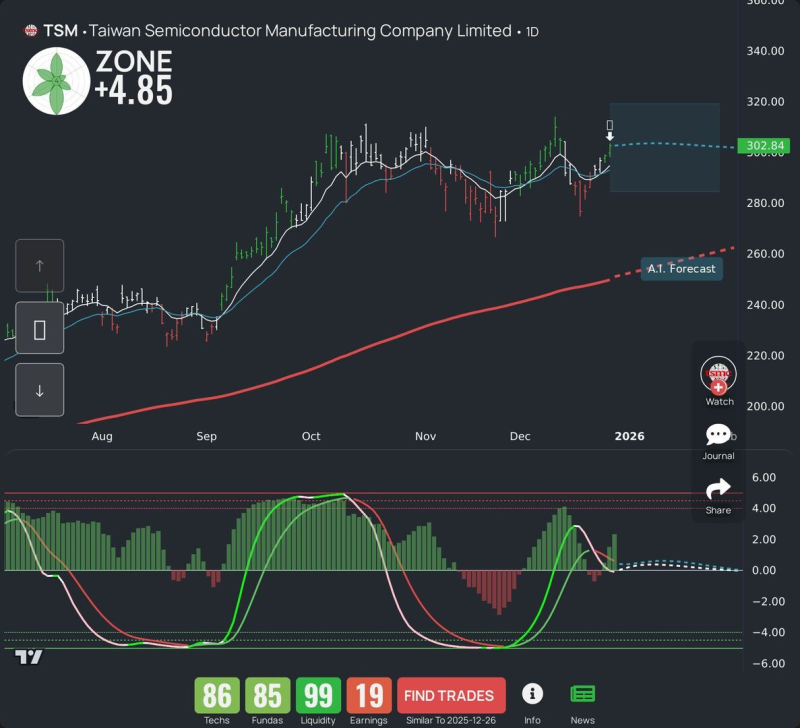

⬤ Taiwan Semiconductor Manufacturing Company (NYSE: TSM) caught traders' attention as shares held firmly above key moving averages while pushing toward $302.84. LEAF analytics and swing-trading tools highlighted a constructive technical picture, with the stock climbing back into the upper range of its projected forecast zone after consolidating through November and early December.

⬤ The technical setup shows TSM regaining strength as shorter-term averages crossed above the 200-day trend line. Momentum indicators flipped from negative back to positive, suggesting buying pressure has returned to the stock.

The forecast suggests potential for continued upward movement if current dynamics hold.

⬤ TSM's position near the $300 level matters because the company sits at the heart of global chip production for data centers, cloud computing, and advanced electronics. Strong technical and fundamental scores on trading dashboards reflect solid liquidity and financial stability, reinforcing confidence in the semiconductor giant's business outlook.

⬤ Any sustained strength in TSM signals broader optimism about chip demand across cloud markets, while a reversal at current levels would likely shift focus back to macro conditions and technology spending cycles across the semiconductor industry.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi