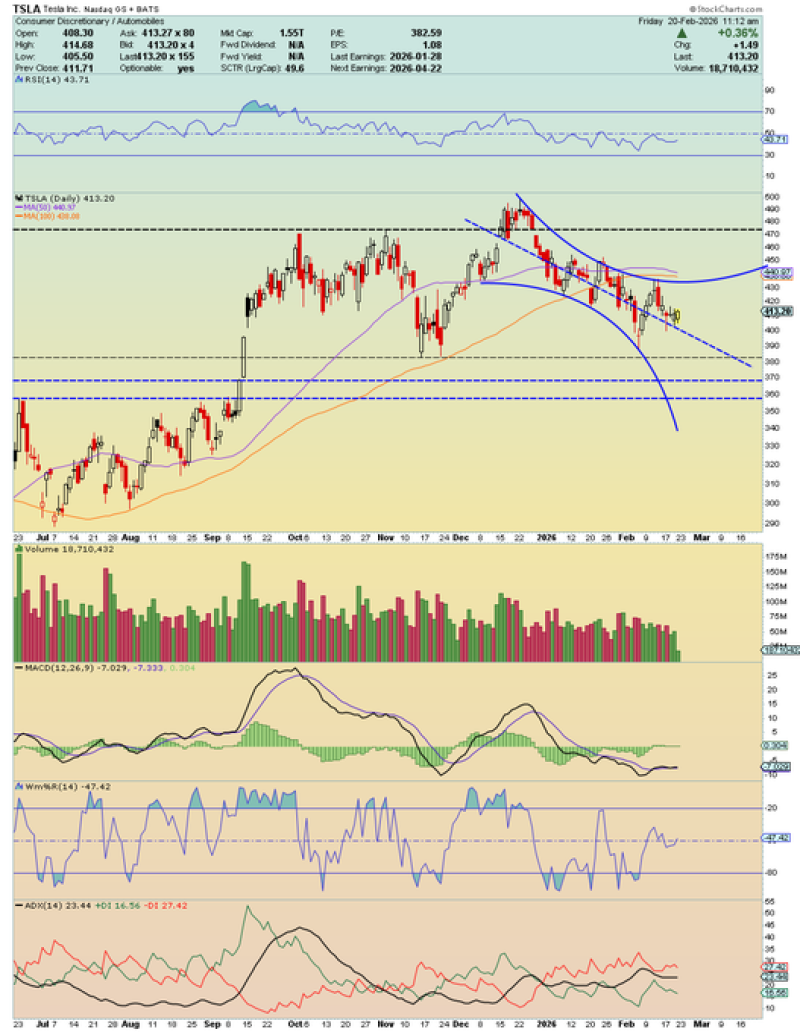

⬤ Tesla shares are quietly consolidating above the 404-409 support range, building energy for what could be the next meaningful move. According to technical commentary tracking TSLA's early bottoming signs at $420, a daily close above 421 would serve as a technical confirmation - opening the door to 427 and higher. The stock was trading near 412-413 at the time of analysis, hovering at the crossroads of key moving averages with volume quietly shrinking, a classic sign that a bigger move is loading.

⬤ The mid-$420s have acted as a resistance cluster in recent weeks, and that zone is exactly where things get interesting. As outlined in analysis of TSLA testing the key $420-$425 zone, price congestion in this area has been building for some time. A push through it would likely squeeze short sellers and shift near-term sentiment toward the bulls. Diminishing volume through this consolidation suggests the breakout - or breakdown - could happen fast once volatility kicks back in.

⬤ On the downside, the 50-day and 100-day moving averages are approaching a decision point. A bullish cross in the shorter average could add fuel to any upside attempt. But if Tesla loses the 404-409 floor, the consolidation range could extend lower. Either way, as highlighted in the broader outlook where TSLA maintains a bullish channel targeting $500 by year-end, the stock's direction from these levels will likely set the tone for the electric vehicle sector and growth tech more broadly through the near term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith