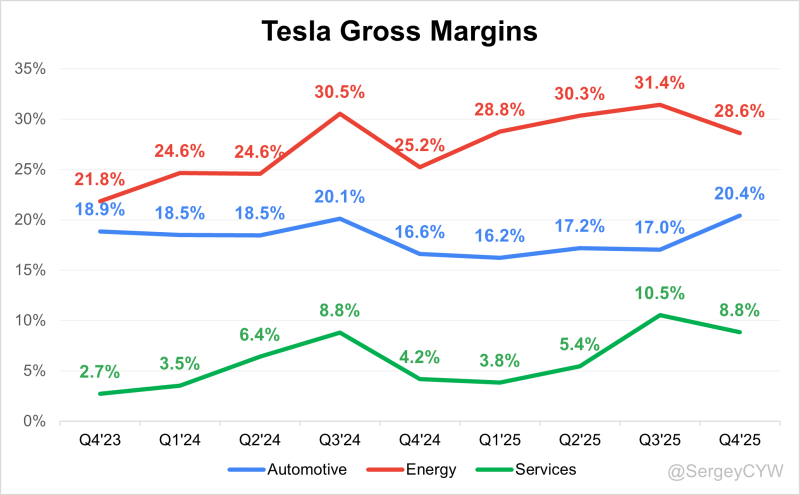

⬤ Tesla's segment-level gross margins show a clear split in profitability across its business lines through 2025. The data reveals margin performance for Automotive, Energy generation and storage, and Services from Q4'23 to Q4'25. While Automotive remains the biggest revenue driver, Energy continues posting the highest gross margins, highlighting its growing weight in Tesla's overall revenue mix.

⬤ Automotive gross margin excluding regulatory credits climbed to 20.4% in Q4'25, up 3.8 percentage points year over year. This happened even as total automotive revenue dropped 10.6% YoY to $17.7 billion, still making up 71.1% of Tesla's total revenue. The numbers show Automotive margins bottoming near 16% in early 2025 before bouncing back steadily through the second half of the year, pointing to better cost control and operating efficiency after earlier margin pressure.

The steady margin expansion across our Energy and Automotive segments demonstrates our ability to drive profitability even as we scale production and navigate market dynamics.

⬤ Energy generation and storage stayed Tesla's most profitable segment on a gross margin basis, hitting 28.6% in Q4'25, up 3.4 percentage points year over year. Segment revenue jumped 25.4% YoY to $3.84 billion, making up 15.4% of total revenue. Energy margins held consistently above 24% throughout the period, peaking above 31% in Q3'25 before pulling back slightly, reflecting solid demand and favorable cost trends in battery storage and energy solutions.

⬤ Services and other operations kept up their gradual margin recovery, with gross margin rising to 8.8% in Q4'25, a 4.7 percentage point gain year over year. Services revenue grew 18.4% YoY to $3.37 billion, representing 13.5% of total revenue. Though Services margins still trail Automotive and Energy, the steady upward move shows improving operational performance. These margin shifts show how Tesla's earnings profile is getting more diversified, with Energy and Services increasingly backing profitability alongside the core Automotive business.

Usman Salis

Usman Salis

Usman Salis

Usman Salis