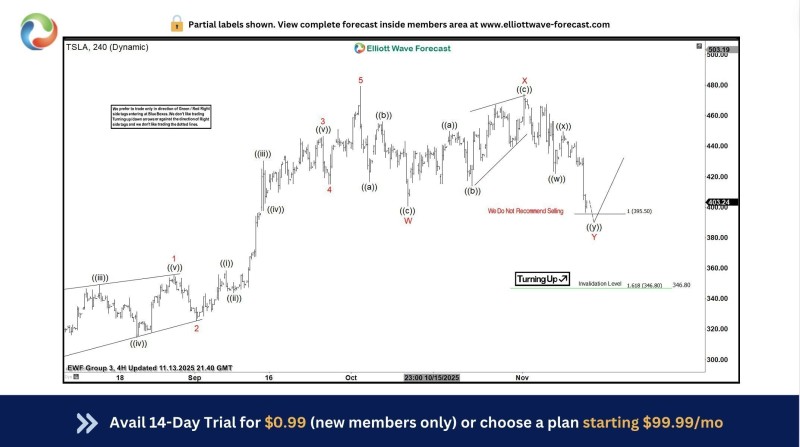

⬤ Tesla stock has moved into a key technical area following a sharp short-term decline, with price consolidating around the $395–$405 range. The chart shows TSLA retracing into an extreme pullback zone after a broader advance, drawing attention from traders monitoring near-term price stabilization.

⬤ The Elliott Wave structure visible on the chart suggests the recent move lower is corrective rather than impulsive. Wave labeling indicates the decline has likely completed a corrective sequence, positioning the stock for at least a three-wave rebound. The chart explicitly notes that selling is not recommended in this area, reinforcing the view that downside momentum may be slowing.

⬤ The projected rebound path points to a short-term recovery rather than a full trend reversal. An invalidation level is marked near $346.80, serving as a key reference point for the current structure. As long as price remains above this level, the corrective rebound scenario remains technically valid.

⬤ This development carries weight given Tesla's influence within the broader technology and growth sectors. Short-term stabilization in TSLA often shapes market sentiment, particularly during periods of elevated volatility. While the chart doesn't imply a sustained bullish continuation, it highlights a pause in selling pressure and potential for a tactical recovery within a wider consolidation phase.

⬤ The current structure suggests downside momentum has reached a temporary limit, opening the door for a corrective bounce before the next directional move becomes clearer.

Peter Smith

Peter Smith

Peter Smith

Peter Smith