- Pre-Orders Pouring In Ahead of the March Release Date

- Concerns About the Overall EV Market Weighing on NIO's Stock

- NIO's Valuation: Overhyped or Justified?

- Stocks still falling

- Long-Term Factors That Will Influence NIO's Stock Performance

- Conclusion: Keep an Eye on NIO's Performance in the Coming Months

Pre-Orders Pouring In Ahead of the March Release Date

With the release just around the corner, many investors are wondering what the future holds for NIO's stock. The ET5 is already generating a lot of buzzes, and pre-orders for the vehicle have been pouring in. The ET5 is expected to be a game-changer for the EV market, boasting a range of over 600 miles on a single charge and a sleek design that is sure to turn heads. With such impressive specs, it's no wonder that the ET5 is generating so much interest.

The NIO ET5 is a highly anticipated electric vehicle from Chinese automaker NIO. The company has been teasing the release of the vehicle for quite some time, and March 2023 is expected to be the month when it finally hits the market.

Concerns About the Overall EV Market Weighing on NIO's Stock

However, despite the excitement surrounding the ET5, NIO's stock has continued to fall in recent weeks. This is due in part to concerns about the overall EV market, which has been facing headwinds in the form of supply chain issues and regulatory challenges. Additionally, some investors are worried that NIO's valuation has gotten ahead of itself, and that the company may be overvalued.

NIO's Valuation: Overhyped or Justified?

The concern around NIO's valuation is not unfounded. The company currently trades at a high price-to-earnings ratio, which has some investors worried that the stock may be overpriced. However, others argue that NIO's strong growth prospects justify the high valuation.

So what does all of this mean for NIO's stock? While it's difficult to predict the future with certainty, it seems likely that the release of the ET5 will have a positive impact on the company's stock in the short term. The volume of ET5s sold in March is expected to be high, which should help boost NIO's revenue and earnings.

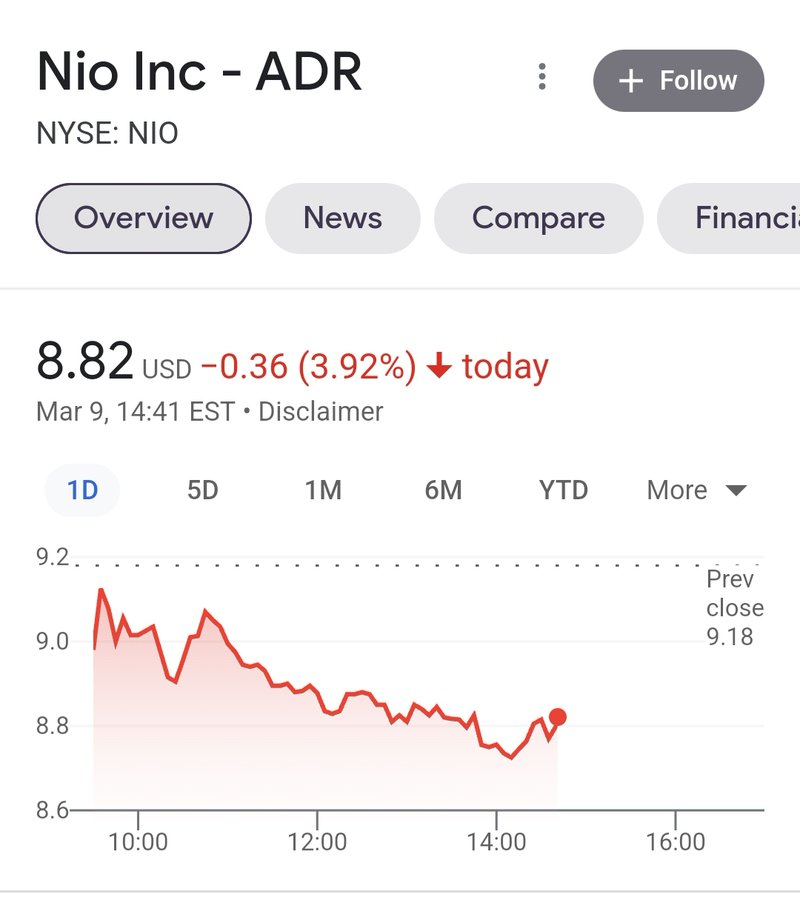

Stocks still falling

Despite the optimistic prognostications made in March, the stocks of NIO, the illustrious Chinese electric vehicle manufacturer, continue to plummet, defying all expectations and leaving investors in a state of disquietude. The current downward trend may be attributed to a variety of complex and interrelated factors, such as market volatility, company performance, and investor sentiment.

Nonetheless, the situation remains bleak, and prudent investors would be well-advised to exercise caution and carefully consider their options before making any decisions regarding the purchase or sale of NIO stocks.

Long-Term Factors That Will Influence NIO's Stock Performance

However, in the longer term, NIO's stock price will likely be influenced by a range of factors, including the overall state of the EV market, NIO's ability to execute on its growth strategy, and investor sentiment. As with any investment, it's important to take a long-term view and not get too caught up in short-term fluctuations.

Conclusion: Keep an Eye on NIO's Performance in the Coming Months

In conclusion, while the volume of NIO ET5 in March is expected to take off, the future of NIO's stock is uncertain. Investors should keep a close eye on the company's performance in the coming months, and make sure to do their due diligence before making any investment decisions.

Peter Smith

Peter Smith

Peter Smith

Peter Smith