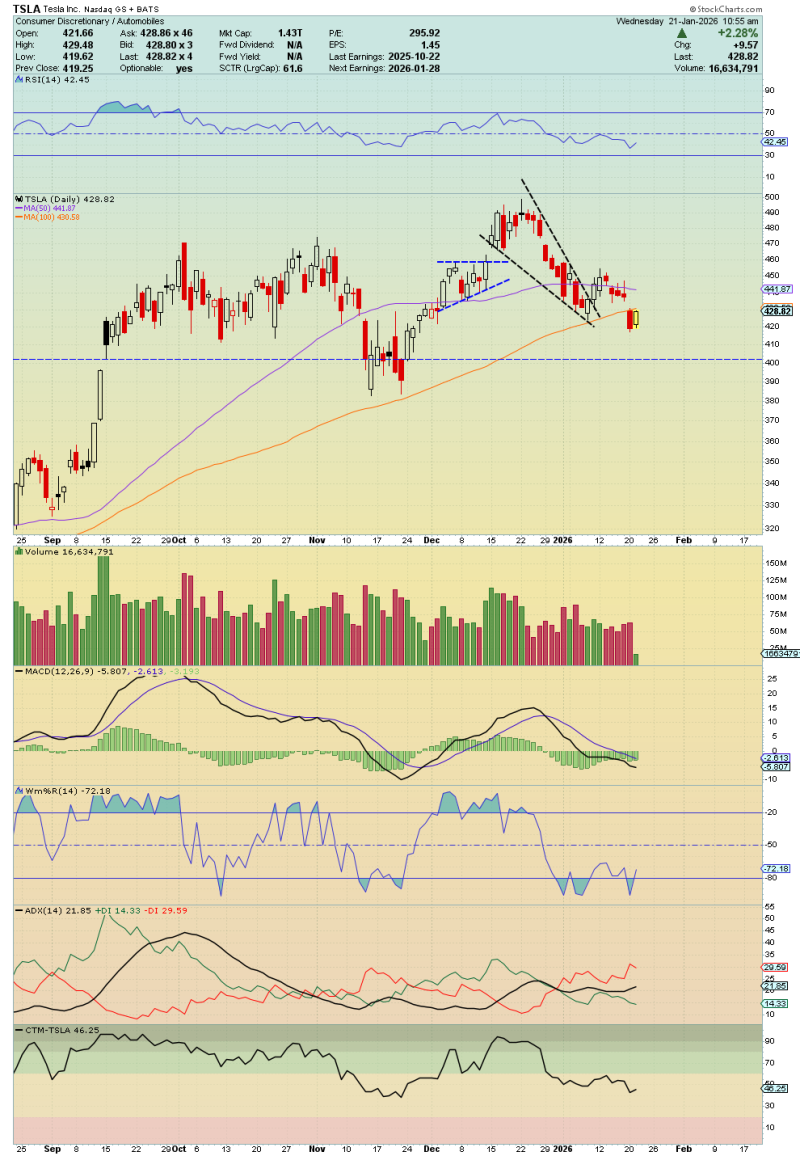

⬤ Tesla shares are holding steady near an important technical marker after briefly slipping below the 100-day moving average. History suggests this could be a familiar pattern – TSLA has bounced back quickly from similar dips in the past, then stayed comfortably above this level for months. Right now, the stock is trying to find its footing around the 428-429 range, just a hair below where it needs to be.

⬤ The 100-day moving average sits around 430, and that's become the line in the sand everyone's watching. What makes this interesting is what happened last time Tesla dropped below this level – it popped right back above it within a single trading session and then cruised above it for over six months. If TSLA can close above 432 on a daily basis, it'll be back in that comfortable zone that's historically led to stronger price action. The 50-day moving average is hanging out in the mid-440s, which would be the next target if the stock can get past this hurdle.

⬤ The technical picture isn't screaming any extremes right now. The RSI is sitting around 42, which is pretty neutral territory – not oversold, not overbought, just kind of hanging out in the middle. Trading volume has calmed down compared to recent spikes, which suggests sellers aren't aggressively pushing it lower anymore. That's actually a decent sign when you're looking for a stock to stabilize.

⬤ This matters beyond just Tesla shareholders. When TSLA moves, it tends to set the tone for growth and tech stocks more broadly. If it can reclaim that 100-day average, it might help settle nerves across the sector. If it can't, we're probably looking at more sideways trading for a while. The next few daily closes are going to tell us a lot about where momentum is headed in the near term.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah