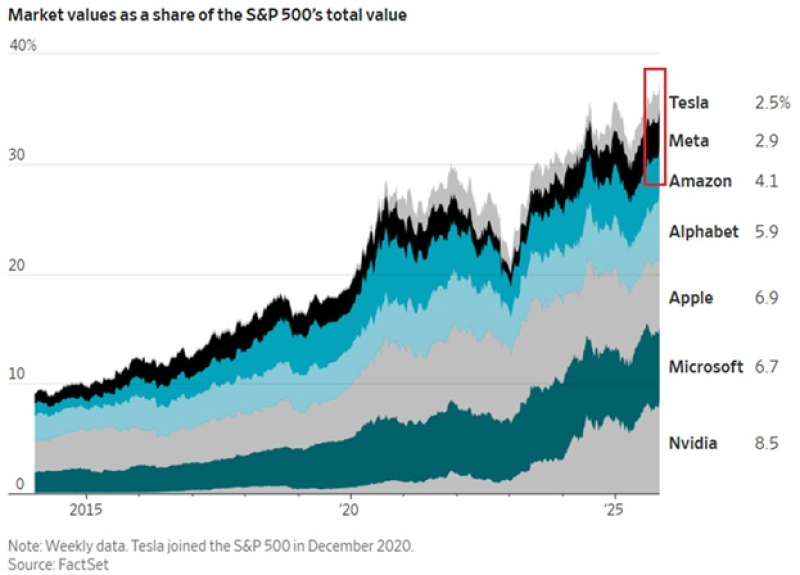

⬤ Market concentration in the S&P 500 has hit levels we've never seen before, with the Magnificent 7 now taking up 38% of the index's total market cap. That's a massive jump from where things stood just a few years back, and it really shows how these megacap tech giants keep pulling further ahead. The group includes Tesla, Meta, Amazon, Alphabet, Apple, Microsoft, and Nvidia—basically the companies driving everything right now.

⬤ Here's the crazy part: Nvidia, Microsoft, and Apple alone make up 22% of the S&P 500's total value. Their combined weight has shot up thanks to the AI boom, cloud infrastructure buildout, and software ecosystems that everyone's banking on. The Magnificent 7's total share has actually doubled since 2020, which really drives home how much these companies have crushed the rest of the market.

⬤ Get this—the top 10 biggest companies in the index now control a record 42% of the overall market cap. The gap between these megacap names and everyone else just keeps getting wider, with Nvidia and its crew basically dictating where the index goes on any given day. We're seeing more and more reliance on just a handful of dominant tech firms whose valuations keep leading the charge across major equity benchmarks.

This level of concentration means the performance of the entire index is increasingly dependent on the direction of NVDA, MSFT, AAPL, and the rest of the Magnificent 7.

⬤ Because when 38% of the index sits in just seven stocks, any moves these companies make can swing the whole market. If Nvidia has a rough day or Microsoft posts earnings that miss, it ripples through everything—sentiment, volatility, sector trends, you name it. This shift also highlights how the U.S. equity game has gone all-in on AI-driven and platform-based business models, cementing megacap technology's central role in global markets.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi