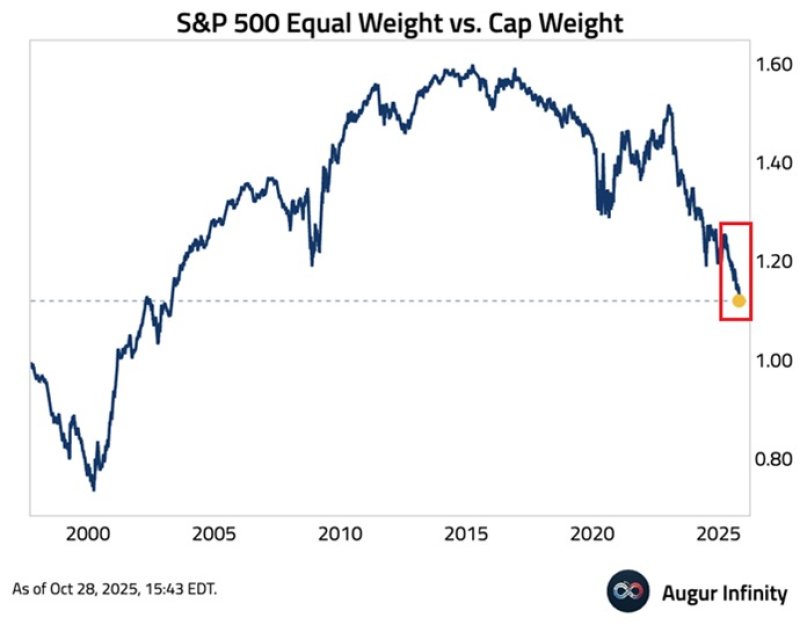

● According to The Kobeissi Letter, the ratio between the equal-weighted and cap-weighted S&P 500 has dropped to 1.11, a level not seen since May 2003. This metric tracks how smaller and mid-sized companies are doing compared to the market's giants. It's now below even the 2008 crisis low of 1.18, showing that gains are increasingly concentrated in a few big tech names — a pattern last seen during the late-90s dot-com era.

● This concentration has reignited debates about capital gains taxes and market structure. Some regulators are considering changes to tax incentives that mainly benefit large-cap tech investors. But experts warn that sudden shifts could hurt smaller hedge funds and push talent toward crypto or private markets. Without better liquidity for small and mid-cap stocks, tax tweaks might just widen the gap.

● The shrinking ratio means most S&P 500 companies are trailing the index's headline numbers. This not only skews our view of market health but could also cut into tax revenues, since fewer stocks are producing real gains. Some industry voices suggest raising corporate taxes on mega-caps instead of penalizing everyday investors — an approach that might stabilize revenue without killing market activity.

● Historically, this kind of dominance by large-cap tech has preceded corrections. If the trend continues, it could mean lower tax receipts overall, as smaller companies that employ more people struggle to raise capital and grow. Despite record index levels, these structural cracks could weaken the broader economy.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah