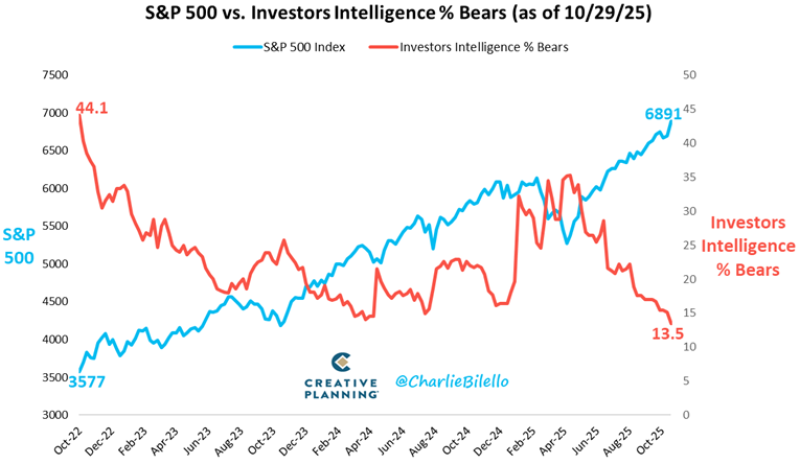

The U.S. stock market keeps hitting new highs, and investor pessimism has practically disappeared. New data shows that bearish investors now make up just 13.5% of the Investors Intelligence sentiment index—the lowest reading since January 2018 and below 98% of all historical observations. The last time sentiment was this one-sided, the market soon faced a sharp correction.

Extreme Optimism Meets Rising Market

According to Charlie Bilello from Creative Planning, who shared the chart, the S&P 500 has surged from 3,577 in October 2022 to nearly 6,900—a gain of over 90% in three years. During that period, the percentage of bears collapsed from 44.1% to 13.5%.

This steep drop signals a fundamental shift in market psychology. Skepticism has given way to euphoria. When nearly everyone turns bullish, history suggests the market may be ripe for at least a temporary pullback. Investors have stopped questioning whether stocks can keep rising and started assuming they will.

Lessons From 2018

The last time bearish sentiment hit these levels in early 2018, the market reversed within months. The S&P 500 suffered a double-digit correction as concerns about interest rate hikes and stretched valuations caught up with prices. Today's conditions echo that period: high valuations concentrated in mega-cap tech, low volatility, and widespread complacency. While optimism alone doesn't cause declines, it leaves markets vulnerable to shocks like weaker earnings, sticky inflation, or unexpected Fed policy shifts.

Can the Rally Continue?

Bulls argue today's environment is fundamentally different. The AI-driven productivity boom, corporate profitability, and easing inflation provide structural support that 2018 lacked. Strong balance sheets and resilient consumer demand continue fueling earnings momentum. However, contrarian investors see these as signs of exhaustion. When nearly all investors are bullish, the market may have priced in perfection, leaving little room for positive surprises and plenty for disappointment.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah