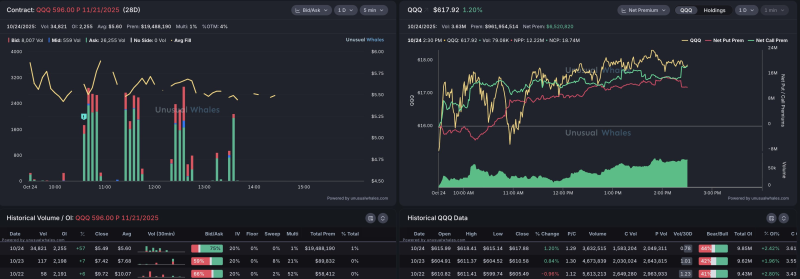

● Someone's making a serious bet against big tech. According to Traveller, options flow data just picked up a massive bearish position on the Invesco QQQ ETF (NASDAQ: QQQ), which tracks the Nasdaq 100. We're talking more than $19.4 million in put options set to expire on November 21, 2025—and most of them were snapped up at the ask price. That usually means one of two things: either someone's really convinced the market's heading down, or they're scrambling to protect a huge position.

● Unusual Whales flagged the trade, and it didn't take long for market watchers to start connecting the dots. When you see this kind of firepower flowing into puts on a major tech ETF, it's worth paying attention.

● So what's behind the move? It looks like growing nervousness around large-cap tech stocks. Sure, the broader market's been holding up fine, but this trade screams short-term caution. Buying puts at this scale is typically about hedging—protecting yourself from a potential drop. Of course, there's always a flip side: if the market keeps climbing or volatility dies down, whoever made this bet could watch millions in premium evaporate.

● Let's talk numbers. The strike price here is $596, which sits about 4% below where QQQ was trading at $617.92. Interestingly, QQQ actually gained 1.20% on the day this trade went through, continuing its recovery from last week's dip. But the sheer size of this order—nearly 35,000 contracts—suggests the trader expects QQQ to slide back toward or even below $600 within the next month. Meanwhile, call option activity on QQQ and related big names like SPY and NVDA stayed relatively quiet, pointing to selective bearish positioning rather than full-on market panic.

● Zoom out a bit, and this trade fits into a bigger picture of uncertainty. Investors are juggling a lot right now: earnings season surprises, questions about interest rate policy, and whether the AI and semiconductor rally still has legs. Big institutional players often use massive put positions like this as insurance against unexpected shocks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith