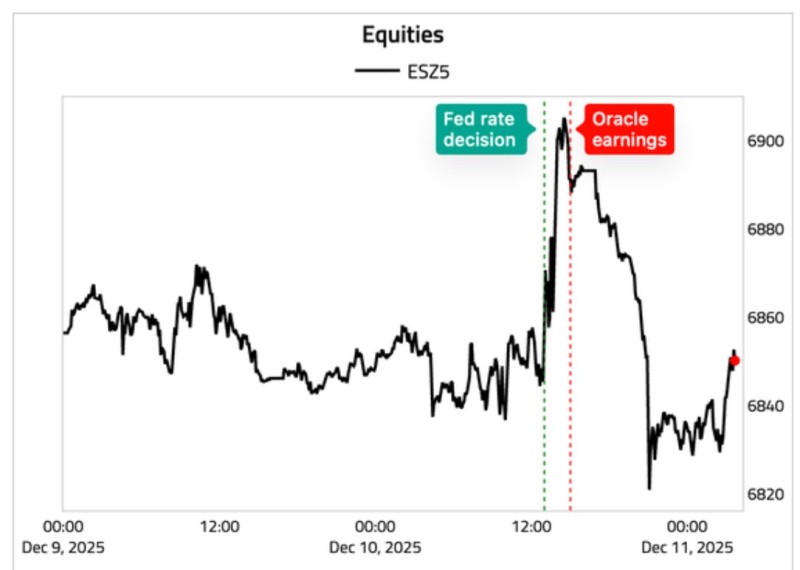

⬤ The market gave us a perfect example of whiplash trading as the Fed's policy call and Oracle's earnings landed almost back-to-back. ESZ5 futures shot higher right after the Fed announcement, pushing from around 6860 toward 6900 in just minutes. Traders were clearly feeling good about the rate decision—at least until Oracle showed up.

⬤ That initial surge looked strong, with ES futures climbing about 40 points and testing the upper end of their recent range. But the mood shifted fast once Oracle dropped its quarterly numbers. The chart tells the story clearly: futures peaked near 6900, then rolled over hard, falling below 6840 as the Oracle reaction spread through the market. That's roughly a 60-point round trip in a matter of hours.

⬤ Oracle's report basically erased everything the Fed gave us earlier in the session. It's a good reminder that even when macro news looks bullish, a single earnings miss from a major name can flip the script completely. The Fed created the bounce, but Oracle brought the reality check—and traders bailed quickly once that weakness showed up.

⬤ The whole sequence shows just how reactive this market is right now. We're bouncing between Fed signals and corporate results, and neither one seems to hold for long. With year-end positioning still in play, these kinds of rapid reversals are becoming the norm rather than the exception.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov