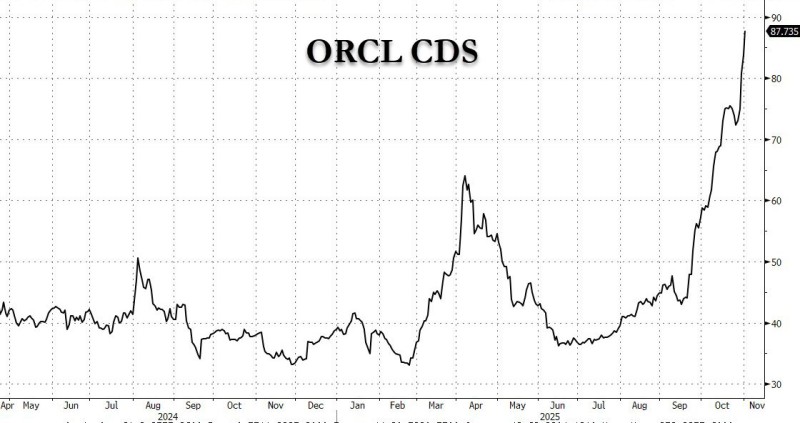

Credit markets are sending warning signals about Oracle Corporation (ORCL). The company's Credit Default Swaps (CDS) have climbed to 87.7 basis points — the highest reading in nearly 18 months. The sharp movement suggests institutional investors are growing more cautious about the company's credit outlook.

Rapid Spike Reflects Growing Credit Concerns

Oracle's CDS widened by 4 basis points today, continuing an aggressive trend that started in early September, according to a zerohedge trader report. The spread has nearly doubled since August 2025, rising from around 40 bps to almost 88 bps in just over two months.

This represents one of the fastest credit repricing events Oracle has seen since 2024's market turbulence.

From Stability to Sharp Deterioration

The data reveals a dramatic shift in market sentiment. Throughout the first three quarters of 2025, Oracle's CDS traded calmly between 30 and 45 basis points. Then spreads started climbing in September, breaking through 60 bps by month's end and pushing past 80 bps in October. The surge to 87.735 bps in early November marks the highest level since mid-2024's credit stress. The steep acceleration suggests traders are rushing to hedge positions, signaling a sudden repricing of Oracle's credit profile.

What's Behind the Movement?

Several factors appear to be converging to drive this shift:

- Elevated borrowing costs: U.S. Treasury yields remain high, making refinancing more expensive for all corporate borrowers, including major tech companies

- Heavy infrastructure spending: Oracle's aggressive push into cloud infrastructure and AI data centers has temporarily increased leverage ratios

- Sector-wide concerns: Broader credit tightening across the technology sector, following cautious guidance from companies like Amazon and Microsoft, has amplified hedging activity around tech debt

- Anticipatory pricing: CDS traders often move ahead of actual credit events, sometimes creating exaggerated swings during uncertain periods

Even without any Oracle-specific crisis, the credit market is clearly pricing in increased uncertainty around the company's debt obligations.

Historical Context and What It Means

Oracle's CDS last approached these levels in April 2024, when liquidity worries briefly rattled the investment-grade tech sector. The fact that spreads have now exceeded that threshold shows renewed anxiety about funding conditions heading into 2026. While a CDS spread near 90 basis points doesn't suggest imminent default risk, it does reflect increased volatility expectations. The market is essentially demanding a bigger premium for protection than it did just months ago.

What Comes Next?

If Treasury yields stabilize and risk appetite returns, Oracle's CDS could drift back toward the 70-75 bps range. However, sustained pressure above 90 bps would signal deeper concerns within the investment-grade credit universe. Even small daily increases at these levels suggest a market pricing in tighter liquidity and higher funding risks. Oracle's debt maintains its investment-grade status, but the credit market's message is clear: investors want a bigger premium to stay protected.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov