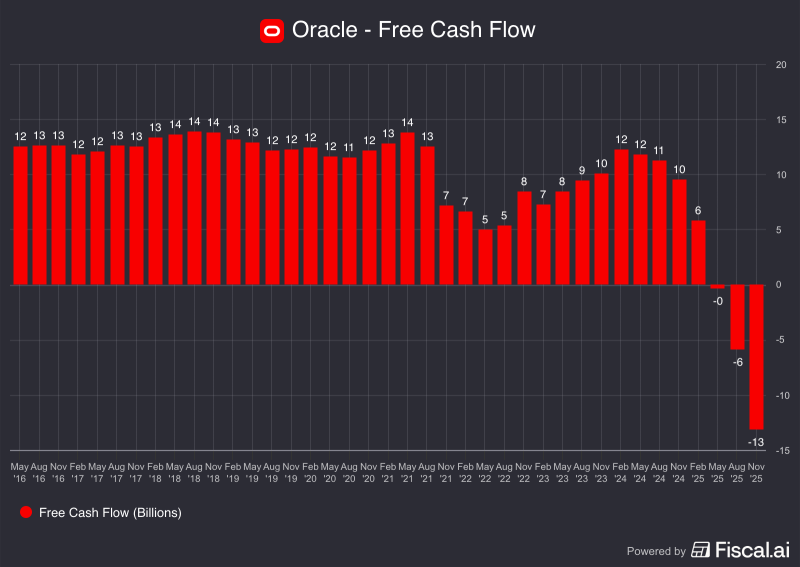

⬤ Oracle $ORCL just broke a twenty-year streak. The tech giant's free cash flow dropped below zero for the first time since the early 2000s, bottoming out at roughly negative 13 billion dollars. This dramatic shift comes as Oracle dumps massive amounts of capital into building out cloud and AI infrastructure to stay competitive in the race for enterprise computing dominance.

⬤ The numbers tell a clear story. For most of the past decade, Oracle comfortably generated between 10 and 14 billion dollars in free cash flow annually. That cushion started thinning in 2021, dipped to around 6 billion earlier this year, and then went off a cliff. The company's now burning through billions to expand data center capacity and beef up cloud services as customer demand keeps climbing.

This shift reflects substantial investment commitments as the company ramps up data center capacity.

⬤ Oracle's betting big on AI compute, and that bet doesn't come cheap. While demand for their cloud services keeps growing, the sheer scale of cash flowing out raises real questions about what they're sacrificing in the short term. For a company that's built its reputation on rock-solid cash generation, this is uncharted territory.

⬤ Oracle's entering an investment phase that could reshape how the market views its financial stability. Negative free cash flow might be temporary, but if it persists, investors will start questioning the company's ability to fund future growth without taking on more debt or cutting back elsewhere. The balance between Oracle's aggressive expansion and maintaining financial flexibility is now front and center for anyone watching the AI infrastructure buildout.

Usman Salis

Usman Salis

Usman Salis

Usman Salis