⬤ Oracle's market story is changing fast. Only three months ago investors felt upbeat about the firm's AI prospects and the order backlog kept swelling - they pushed the share price up roughly 40 percent. The momentum looked unstoppable besides Oracle appeared set to win the AI infrastructure race.

⬤ Now the talk has turned to a harder issue - how will Oracle pay for all this growth? The backlog still widens - yet the capital demands widen with it. Building AI infrastructure costs a great deal and the payoff now looks farther away than many first thought.

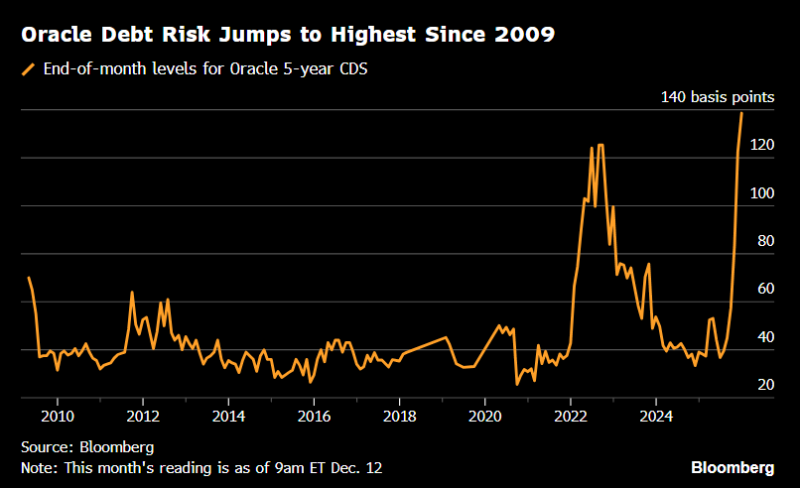

⬤ Bond markets are flashing a warning. Oracle's five year credit-default-swap spread has leapt to 140 basis points, the highest level since the financial crisis. That sharp rise within ninety days shows investors are seriously worried about the amount of debt the company is taking on to fund its cloud or AI ambitions.

⬤ This is important because it reveals a clear strain in Oracle's plan. The AI opportunity is large, but seizing it demands huge upfront outlays. Credit markets now doubt whether the balance sheet can bear the load. Higher borrowing costs could oblige Oracle to scale back expansion or slow the AI build out just when momentum is most needed.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi