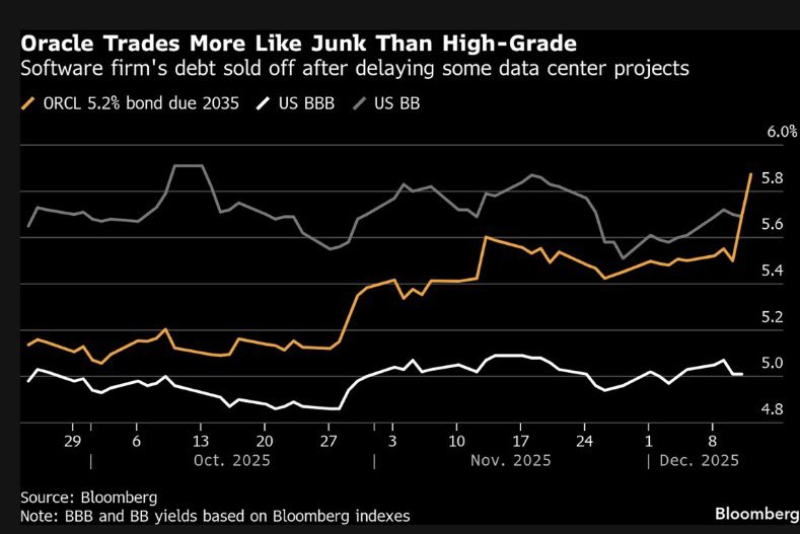

⬤ Oracle's bonds are getting hammered in debt markets right now. The company's 5.2% notes maturing in 2035 took a nosedive after Oracle pushed back parts of its data center buildout, sending yields sharply higher. Investors are basically rethinking how risky it is to lend money to Oracle given these execution problems.

⬤ Here's what's really catching attention: Oracle's bond yields climbed to around 5.8%, which puts them way closer to BB-rated junk territory than anything you'd expect from an investment-grade company. That's a massive gap from typical BBB benchmarks. Markets are demanding a much bigger premium to hold Oracle debt, even though the rating agencies haven't downgraded the company yet.

The bonds are increasingly being used as a hedge against potential adverse developments across the broader software and technology sector.

⬤ This isn't just about Oracle anymore. Traders are using these bonds as protection against broader problems brewing in tech. Higher interest rates are squeezing everyone, data center projects require enormous capital, and there's real uncertainty about whether the whole sector can keep growing at the pace everyone assumed. That's forcing a repricing of credit risk across major technology issuers.

⬤ Bond yields moving like this matters because they usually spot trouble before stock prices do. When investment-grade debt starts trading like junk, it changes funding costs and shifts how people view risk across credit markets. Oracle's situation shows how fast confidence can evaporate when execution stumbles, especially for tech companies betting big on infrastructure spending.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah