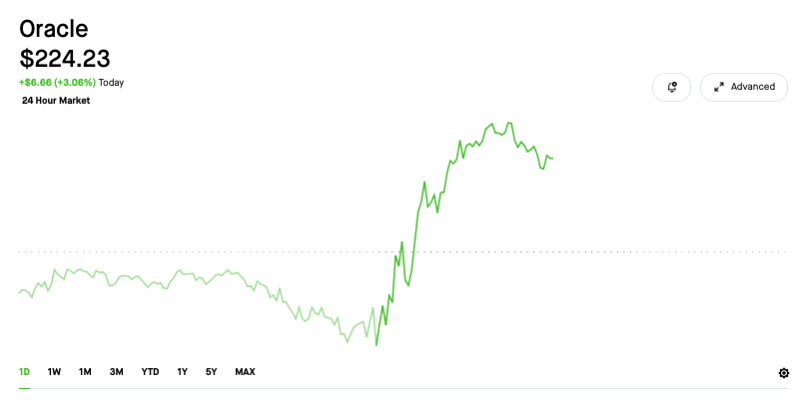

⬤ Oracle climbed to $224.23, posting a 3.06% daily gain after a sharp intraday breakout. The stock traded flat most of the session before surging vertically and holding near the upper range. Meanwhile, Oracle credit derivatives jumped as traders increasingly hedge what they see as growing AI-linked risks around the company.

⬤ The rise in credit derivatives usually signals heightened market sensitivity rather than actual financial trouble. In Oracle's case, it looks like traders are protecting their positions as AI sector volatility picks up. But the stock itself kept climbing—holding above $220 through the afternoon—showing that equity buyers remain confident in Oracle's AI and cloud outlook.

⬤ This combo of a strong stock rally and spiking credit hedging shows just how much AI trends are shaping both equity and credit markets right now. As hedging around AI-exposed companies intensifies, expect sharper price swings and faster sentiment shifts—with Oracle sitting right in the middle of it all.

Usman Salis

Usman Salis

Usman Salis

Usman Salis