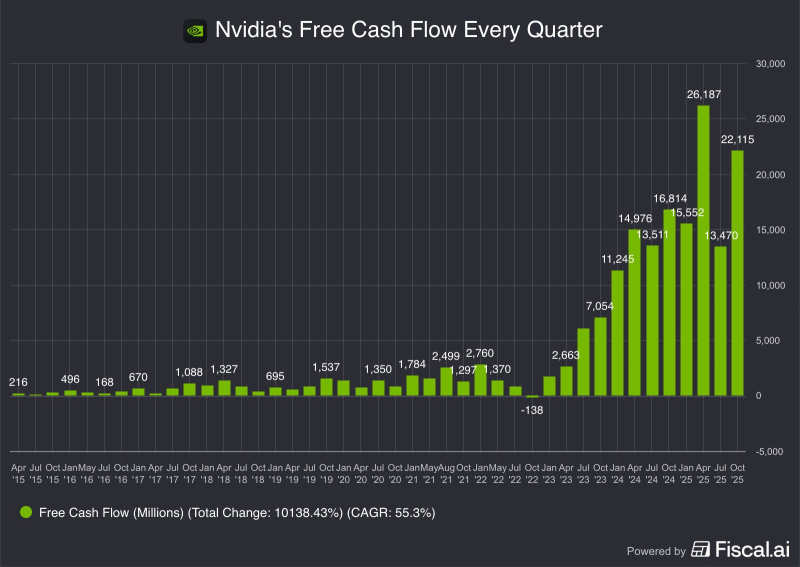

⬤ Nvidia keeps setting new records - its free cash flow reached 26.2 billion dollars in the first quarter of 2025, up from only 216 million dollars in the first quarter of 2015. Over ten years demand exploded for AI hardware, high performance computing and data-center equipment. The figures do not show small gains - they show a total overhaul of the company's business model plus confirm that Nvidia now dominates the chip sector.

⬤ From 2015 through 2020, quarterly free cash flow stayed modest and drew little notice. Momentum rose in 2021 then shot upward in 2023. The company reported 11.2 billion dollars then 14.9 billion then 16.8 billion but also now 26.2 billion. That equals a yearly compound growth rate of 55.3 percent, a figure that prompts investors to look twice. The climb has stayed smooth, with almost no setbacks.

The surge in free cash flow highlights Nvidia's expanding economic footprint and its increasing influence across the AI as well as semiconductor sectors.

⬤ The sharpest jump began in mid-2023 and ran through 2024, as buyers everywhere scrambled for Nvidia AI processors and data center platforms. Each quarter delivered higher cash inflows proving that the firm sells more chips or also runs its operations with strict discipline. Today's free cash flow dwarfs the totals seen before 2020 showing that the company now plays in a different class.

⬤ Large free cash flow grants Nvidia the power to expand output, fund research and survive market shocks without strain. The company's path also reflects the wider shift toward high performance computing, with Nvidia at the core. As AI keeps spreading through every industry, Nvidia's financial strength allows it to set the rules for the sector well into the future.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova