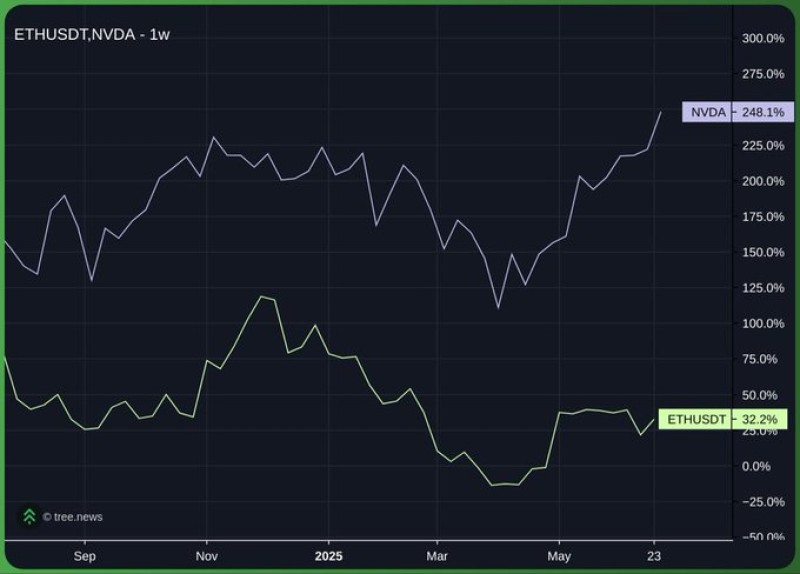

In a striking comparison of traditional tech versus crypto assets, Nvidia (NVDA) has dramatically outperformed Ethereum (ETH) over the past year. According to data shared in a recent trader post and visualized by tree.news, NVDA recorded a +248.1% return, while ETH trailed behind with just +32.2% over the same period.

This performance gap has reignited the "real tech vs. fake tech" debate in financial circles — and it’s prompting traders to reassess how they allocate capital in today’s volatile macro environment.

NVDA’s Parabolic Run Leaves Crypto Behind

Nvidia’s rally is no accident. Riding on AI optimism and continued data center expansion, the chip giant broke new all-time highs in May 2025. The chart illustrates NVDA’s nearly 250% gain in under 12 months, reflecting investor confidence in AI-driven growth and tangible revenue.

Traders who employed a DCA (Dollar-Cost Averaging) strategy with NVDA during the year would now be sitting on significant profits. The trader in the referenced tweet even argues this return beats the broader market by at least 200%.

ETH Struggles to Reclaim Momentum

While Ethereum (ETH) remains the backbone of the decentralized finance (DeFi) and Web3 ecosystems, its recent performance has disappointed many investors. Over the same period, ETH has gained just +32.2%, failing to reclaim its early 2025 highs.

The chart indicates ETH’s price movement was largely flat to negative for most of the year, despite bullish narratives around Layer 2 scaling and ETF speculation. Compared to NVDA, Ethereum looks stalled — and that’s fueling critiques labeling it as “overhyped tech.”

Conclusion

The performance divergence between Ethereum (ETH) and Nvidia (NVDA) sends a strong signal: in times of uncertainty, markets may prefer companies with real revenue and product-market fit over speculative assets. While ETH’s long-term potential remains tied to blockchain adoption, the short-term market clearly favors NVDA and the AI revolution.

With Nvidia showing no signs of slowing down, and Ethereum still struggling to build momentum, the real question for traders is: where will the next 10x opportunity come from — code or chips?

Usman Salis

Usman Salis

Usman Salis

Usman Salis