Nvidia (NVDA) shares surged as analysts from Bank of America and UBS reaffirmed the stock as a top pick, downplaying the impact of a reported delay in the Blackwell AI chip.

Nvidia (NVDA) Stock Gains Momentum as Analysts Back the Stock

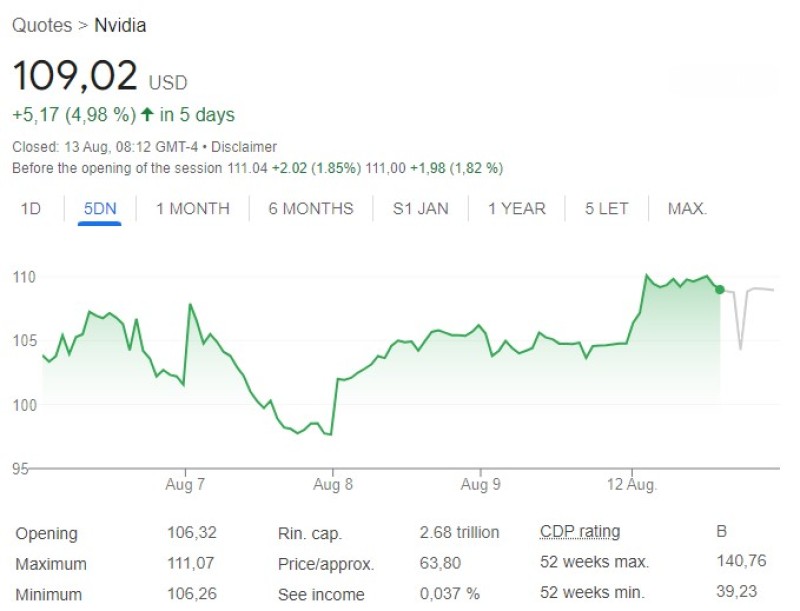

Nvidia (NVDA) shares surged over 4% on Monday following strong endorsements from top financial analysts. Bank of America and UBS analysts highlighted the company's robust market position and continued potential for growth, despite concerns over a reported delay in Nvidia's latest AI chip. The stock has already seen an impressive rise of about 120% this year, although it remains below the peak levels observed earlier in the summer.

UBS analysts addressed concerns regarding a potential delay in the launch of Nvidia's Blackwell artificial intelligence (AI) chip. Initial reports suggested a delay of up to three months, causing some market unease. However, based on discussions with Nvidia's customers, UBS now expects the delay to be much shorter—approximately four to six weeks. They emphasized that this delay would likely be "invisible to most, if not all, end customers," mitigating the potential negative impact on Nvidia's market performance.

Bank of America Labels Nvidia a 'Top Pick'

Adding to the positive sentiment, Bank of America analysts reinforced their bullish stance on Nvidia, labeling the stock as a 'top pick.' They pointed to Nvidia's significant exposure to the rapidly growing data center market, which is poised to benefit from increased infrastructure spending by cloud-computing giants. This, coupled with the rising demand for AI-driven solutions, positions Nvidia favorably in the eyes of investors.

Both UBS and Bank of America analysts remain optimistic about Nvidia's future, citing the ongoing rise in AI spending and the growing demand for enterprise solutions as key drivers for the company's growth. UBS maintained its "buy" rating on Nvidia stock, with a price target of $150, reflecting confidence in the company's ability to navigate any short-term challenges and capitalize on long-term opportunities.

With Nvidia's strong market position and continued innovation in AI technologies, analysts see considerable upside potential for the stock. Despite the slight setback with the Blackwell chip, Nvidia's ability to meet the surging demand for AI infrastructure positions it well for future growth. Investors are likely to remain optimistic, buoyed by the positive outlook from leading financial institutions.

Conclusion

Nvidia's recent stock performance, bolstered by analyst endorsements, reflects the company's pivotal role in the AI and data center markets. As the industry continues to expand, Nvidia's innovative technology and strategic market position are likely to keep it at the forefront of investor attention, even amid minor setbacks like the Blackwell chip delay. The reaffirmation of Nvidia as a top pick by major financial analysts underscores the company's potential for sustained growth and market leadership.

Usman Salis

Usman Salis

Usman Salis

Usman Salis