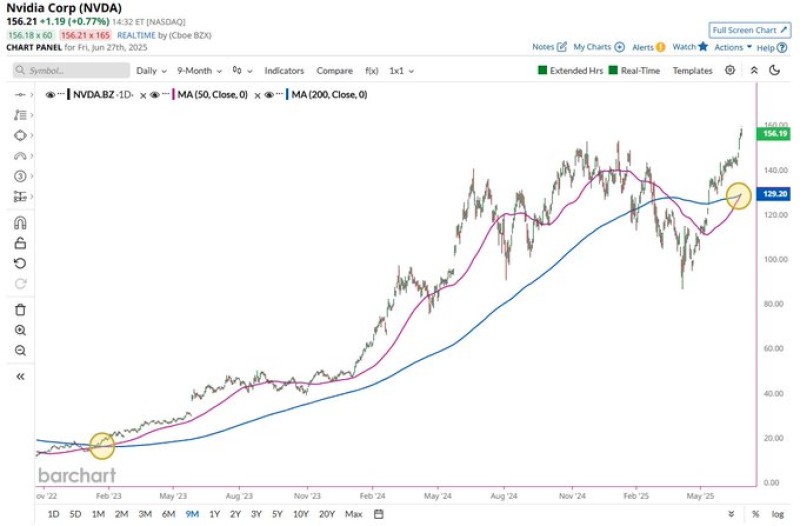

Nvidia Corp (NVDA) has just triggered a widely-watched bullish technical pattern — the Golden Cross — for the first time since January 2023. According to a recent post by Barchart on X, this crossover between the 50-day and 200-day moving averages previously signaled a multi-year rally of nearly 700%.

Golden Cross Flashes a Bullish Setup

As of June 27, 2025, Nvidia shares are trading at $156.21, marking a +0.77% gain for the day. The 50-day moving average has just crossed above the 200-day moving average near $129.30 — a formation widely interpreted as a bullish signal that may indicate the start of a longer-term uptrend.

Could Nvidia Repeat Its Historic Run?

With NVDA now trading at $156.21 and breaking above key technical levels, momentum appears to be building. The last time this setup occurred, the stock gained 695% in the following two years. While technical patterns don’t guarantee outcomes, the timing and structure echo a familiar script for long-term investors.

Conclusion

The return of the Golden Cross has put Nvidia (NVDA) back on traders' radars. With the stock near highs and momentum increasing, many are watching to see if history will repeat. Given Nvidia’s central role in AI and chip development, the technical setup may be more than just a chart pattern — it could be a launchpad.

Peter Smith

Peter Smith

Peter Smith

Peter Smith