Nvidia (NVDA) financial story is one of the most stunning transformations in market history. What started as a graphics chip company for gamers has become the backbone of the global AI revolution and the world's most valuable semiconductor firm.

From Graphics Cards to AI Dominance

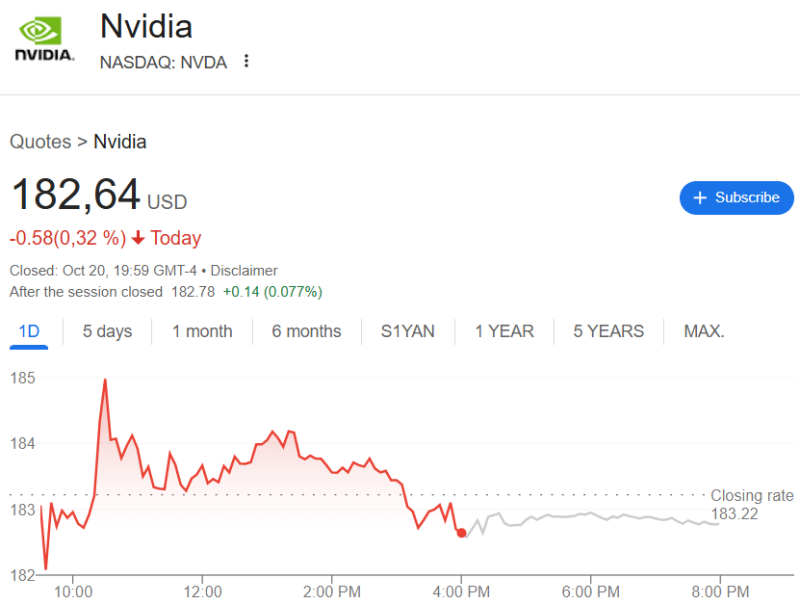

The company's market cap has exploded from $550 million in 1999 to $4.5 trillion today, as trader Evan recently highlighted.

This isn't just impressive growth—it's a complete reimagining of what the company does and why it matters.

Nvidia didn't just ride the AI wave; it built the infrastructure that made it possible.

The Growth Timeline

Looking at Nvidia's October valuations since going public in January 1999 tells the story clearly.

Early years showed steady but modest gains through the dot-com era. Then things started accelerating—$13 billion in 2015 jumped to $36 billion in 2016 as AI research took off. By 2017, the company hit $105 billion. The $500 billion mark came in 2021, fueled by pandemic digitalization and exploding AI investment. The trillion-dollar threshold fell in 2023, and now we're at $4.5 trillion in 2025.

The pattern shows three clear phases:

- 2000-2015: Slow and steady growth driven by innovation

- 2016-2020: Significant acceleration as gaming and data centers boomed

- 2021-2025: Parabolic expansion as AI infrastructure became essential

Even the pullbacks in 2008, 2018, and 2022 just set up higher floors for the next rally.

Why Nvidia Won

Nvidia's success comes down to being in the right place with the right technology at exactly the right time. Their GPUs turned out to be perfect for AI training—the parallel processing architecture that made graphics beautiful also made machine learning possible. ChatGPT, Gemini, Claude, and every other major AI model runs on Nvidia chips. The CUDA software platform locked in developers and created a moat that competitors still struggle to cross.

The AI data center boom turbocharged everything. Microsoft, Amazon, Google, and Meta are all scrambling for Nvidia chips to power their AI ambitions. Beyond data centers, Nvidia's pushing into robotics, self-driving cars, and edge computing, opening up entirely new revenue streams.

That said, the valuation brings risk. Supply chain issues, competition from AMD and custom chip designs, and geopolitical tensions around semiconductor trade could create headwinds. But right now, Nvidia's lead looks pretty secure.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi