Warren Buffett once said something that sounds simple but cuts deep: "Price is what you pay. Value is what you get." It's one of those quotes that gets thrown around a lot, but NVIDIA's recent run actually shows what it means in practice. The company's stock chart tells a pretty clear story—when earnings grow faster than the share price, patient investors usually come out ahead, even if the valuation looks scary at first glance.

Buffett's Principle Meets NVIDIA

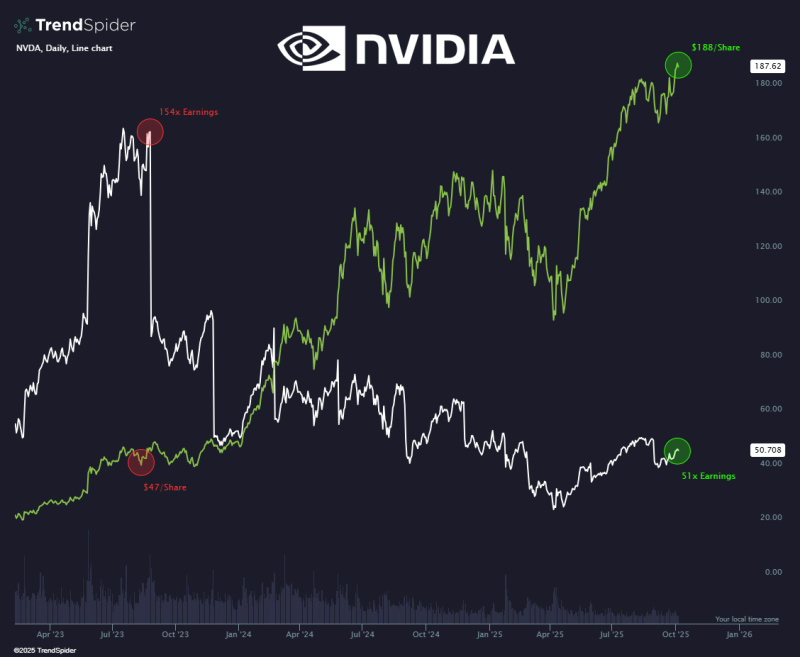

A recent tweet from TrendSpider pointed out that NVIDIA's trajectory is basically a textbook example of how solid earnings growth can fuel long-term gains. Sure, high valuations make people nervous—that's completely natural. But when the business underneath keeps getting stronger, the stock price tends to catch up eventually. NVIDIA is proving that point right now.

Chart Signals: Earnings Outpace Price

- Past Peak Valuation: Back in mid-2023, NVIDIA was trading at a wild 154 times earnings. Most analysts thought that was completely unsustainable, and honestly, they had a point.

- Valuation Reset: Here's where it gets interesting. As earnings absolutely exploded while the stock took a breather and consolidated, NVIDIA's multiple actually dropped to about 51 times earnings by late 2025. That's still high by traditional standards, but it's a massive compression.

- Share Price Strength: Despite the valuation coming down, NVIDIA's stock climbed from around $47 per share in mid-2023 to $188 today. That's the earnings growth doing the heavy lifting—exactly what Buffett was talking about.

The chart compares NVIDIA's stock price (shown in green) with its earnings multiple trajectory (in white), and the pattern is pretty clear. Investors who looked past the scary headline numbers and focused on the underlying business fundamentals ended up getting rewarded.

Why This Matters for Investors

NVIDIA's growth story isn't slowing down, and it's built on some really solid foundations. There's explosive demand for AI chips and data center solutions—basically everyone building AI infrastructure needs what NVIDIA makes. The company is also pushing into AI-driven software and services, which diversifies the revenue base. And despite all this growth, they're maintaining resilient margins with strong free cash flow, which is rare for companies expanding this aggressively.

Even as the valuation multiple contracted—which usually puts downward pressure on stock prices—the fundamental earnings strength more than made up for it. That's what kept the long-term trajectory pointing up.

Forward-Looking Outlook for NVDA

NVIDIA remains one of those stocks everyone's watching. The valuation is still elevated if you compare it to traditional benchmarks—no one's arguing it's cheap. But several factors keep the bulls engaged. AI adoption is accelerating faster than most people expected a couple years ago. Global data center buildouts are happening at massive scale. And NVIDIA's dominance in the GPU and AI accelerator markets isn't really being challenged in a meaningful way right now.

The big question mark is whether earnings can keep expanding fast enough to justify even today's lower multiples. If growth slows, the stock could face real pressure. But if the AI boom continues, NVIDIA is positioned to ride that wave.

Usman Salis

Usman Salis

Usman Salis

Usman Salis