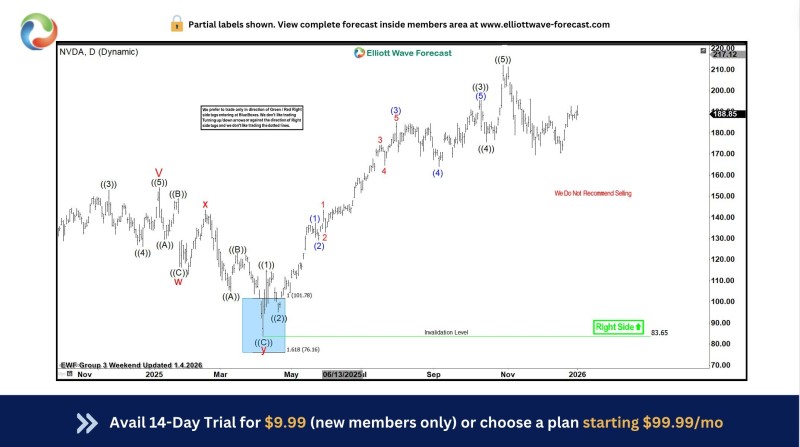

⬤ Nvidia stock (NVDA) has extended its recovery following a sharp reversal from the $100–$110 support region earlier this year. After initially dropping into that zone, NVDA reversed direction and has since climbed to the upper $180s, breaking above prior highs. The technical structure suggests the bullish trend remains firmly in place.

⬤ The technical analysis shows multiple completed wave cycles, with NVDA moving higher in a strong sequence after bottoming near key Fibonacci levels. This confirmed the upward trend was still active. The current structure continues to favor buyers as long as Nvidia holds above critical support levels.

⬤ Nvidia remains one of the top performers in the semiconductor and AI-hardware sector, with its long-term technical picture staying bullish. The stock continues forming higher lows within its broader upward cycle, and the preferred direction points toward further gains as the trend stays favorable.

⬤ This matters because Nvidia is a leading stock in the tech sector, and its strength often influences sentiment across growth and AI-related stocks. With the technical setup still supporting upside movement, the outlook for NVDA's long-term trend remains positive.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah