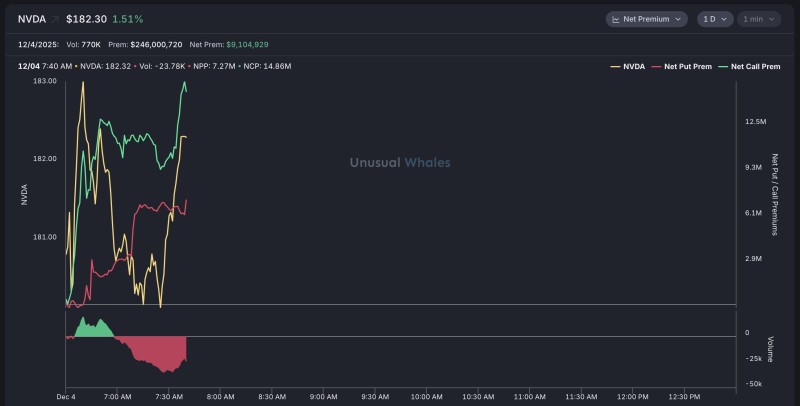

⬤ Nvidia pushed higher Monday morning, gaining 1.5% to reach $182.30 as options traders ramped up bullish bets. NVDA saw its net call premium strengthen significantly during the opening session, matching the stock's climb from the $181 level. The momentum built steadily through the first hour of trading.

⬤ The data shows Nvidia generated $246 million in total premium volume with roughly 770,000 shares changing hands. Net call premium surged to nearly $14.86 million by 7:40 a.m., while net put premium stayed negative around $7.27 million—showing traders weren't rushing to buy downside protection. The stock's price action tracked these flows closely, breaking above $182 as call demand picked up steam.

⬤ The morning chart reveals NVDA swinging through some volatility before finding its footing in a clear uptrend. Initially, overall net premium dipped negative, but that flipped as call-side pressure took over. This shift captures how sentiment turned more optimistic as the session progressed and bullish options activity dominated.

⬤ This matters because options flow in major tech stocks like Nvidia often sets the tone for broader market sentiment. When rising prices combine with strengthening net call premium, it signals growing conviction in the stock's near-term path. Today's data offers a window into how traders positioned themselves around NVDA during the opening hours.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets