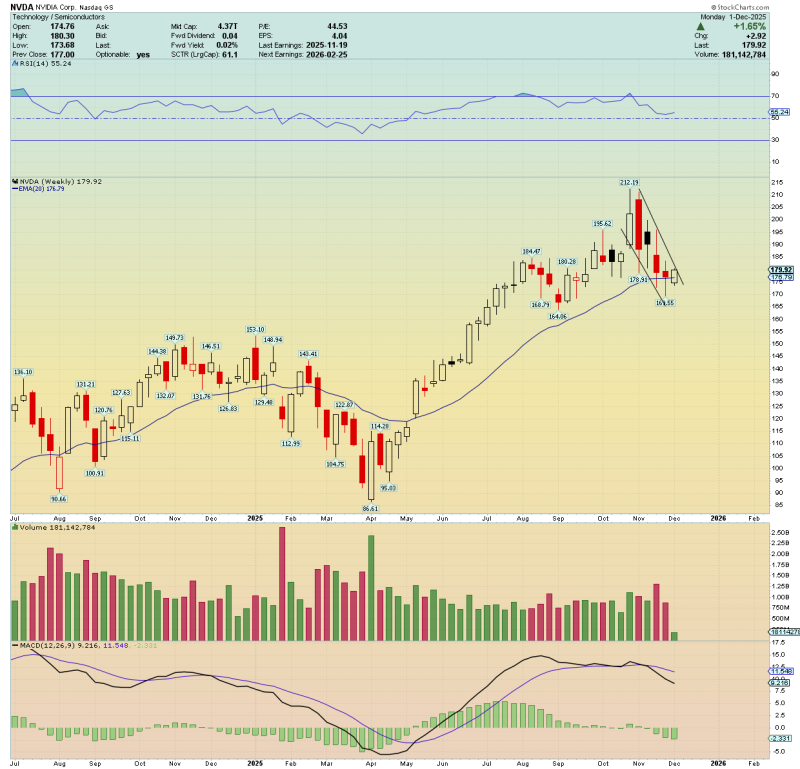

⬤ Nvidia stock is showing signs of recovery after pulling back roughly 20% from its recent peak near $212. The weekly chart is gaining strength, suggesting the early stages of a possible turnaround. Price action has retested the rising 20-week EMA around the mid-$170s, with NVDA demonstrating notable relative strength during the latest trading session.

⬤ The decline brought shares down to approximately $168.55, where buying interest kicked back in. Volume remains elevated compared to earlier periods, while momentum indicators like the MACD are flattening out—pointing to easing downside pressure. The technical setup looks healthier as long as the 20-week EMA continues holding as support.

⬤ Nvidia's price behavior reflects broader resilience in semiconductor stocks. Despite recent volatility, NVDA has maintained a higher-low pattern through much of 2025, backed by solid earnings and ongoing demand for AI and data-center chips. The chart shows repeated tests of rising moving averages that have historically led to renewed upside momentum. With price attempting to break out of a short-term descending channel, buying interest appears to be building.

⬤ This matters for the wider market, given Nvidia's leadership position in the chip sector. A sustained bounce from the 20-week EMA would reinforce sector strength and help stabilize sentiment across high-growth tech stocks. Near-term upside targets at $200 and $215 are key levels to monitor as NVDA works to reestablish upward momentum heading into the next earnings cycle.

Peter Smith

Peter Smith

Peter Smith

Peter Smith