The options market for Nvidia is lighting up with heavy institutional activity. Traders are loading up on long-dated call contracts, showing a clear bullish bias that signals confidence in Nvidia's position as the leader in AI and semiconductor innovation. Despite recent consolidation around $207–$208, smart money appears to be positioning for significant upside in the coming years.

Institutional Flow Turns Strongly Bullish

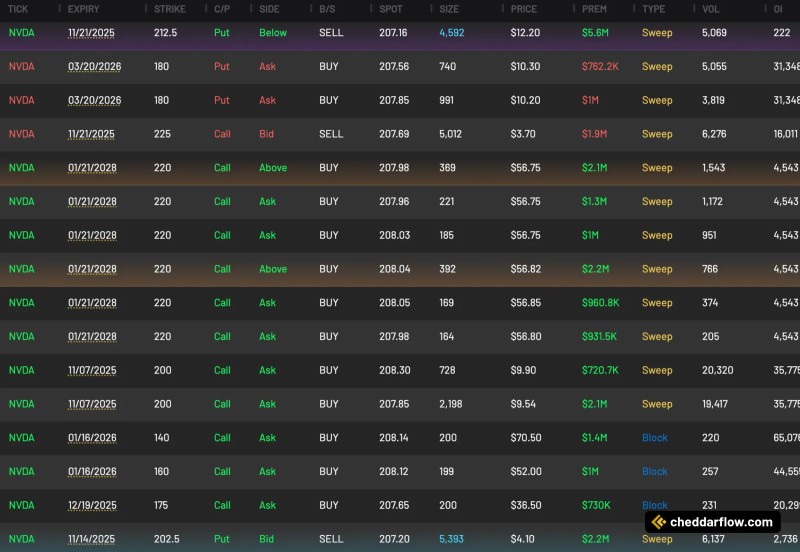

According to data from Cheddar Flow, recent options activity for NVDA was overwhelmingly bullish. Call buying dominated across multiple expirations, with particular focus on January 21, 2028 contracts.

Several large sweeps — each valued between $1 million and $2.2 million — targeted the $220 strike call, with trades executing above the ask at prices near $56.75–$56.85. These aggressive sweep orders indicate high-conviction institutional bets, suggesting strong expectations for continued share price appreciation.

Key Flow Details

The trading tape reveals significant positioning: Eight separate sweeps on the $220 calls for January 2028, each exceeding $900K–$2.2M in premium, collectively representing over $10 million in bullish exposure. A massive $5.6M put sell order at the $212.5 strike for November 2025 likely represents a bullish strategy — either selling puts to collect premium or expressing confidence the stock will stay above that level. More than 20,000 contracts traded on $200 calls for November 2025 at $9.50–$9.90, signaling near-term optimism. Multiple 2026 calls at strikes between $140–$175 saw block trades ranging from $730K to $1.4M, reflecting accumulation in mid-term bullish positions. Overall, the order flow shows overwhelming call-side dominance, with traders aggressively positioning for Nvidia to rise well into 2026–2028.

Market Context and Momentum Drivers

Nvidia sits at the center of the global AI infrastructure boom, supplying the GPUs that power large-scale language models and enterprise AI systems. Growing demand for its Blackwell and H200 chips, combined with ongoing expansion in data center partnerships with Microsoft, Amazon, and Google, has cemented its role as the backbone of the AI sector. This latest wave of options activity comes as the stock stabilizes near $207 after months of sideways trading. Institutional investors seem to view this consolidation phase as a setup for the next leg up, placing bets that AI hardware spending will accelerate through the rest of the decade.

Technical and Sentiment Outlook

While Nvidia's share price has cooled from earlier highs, traders are using options to gain leveraged exposure ahead of potential earnings catalysts or AI demand surges. The combination of long-term call sweeps and near-term support at $200–$210 suggests investors are preparing for renewed volatility — likely to the upside. The absence of significant put accumulation also reflects low downside conviction, reinforcing the broader bullish sentiment across the semiconductor space.

Peter Smith

Peter Smith

Peter Smith

Peter Smith