NVIDIA is heading into its earnings report with unusual confidence from prediction markets. Latest Polymarket data puts the probability of an earnings beat at 96%, showing intense optimism from traders before the announcement. With sentiment running this high, the outcome could ripple across AI stocks, chipmakers, and the broader equity market.

Prediction Markets Show Heavy Confidence in NVDA Beat

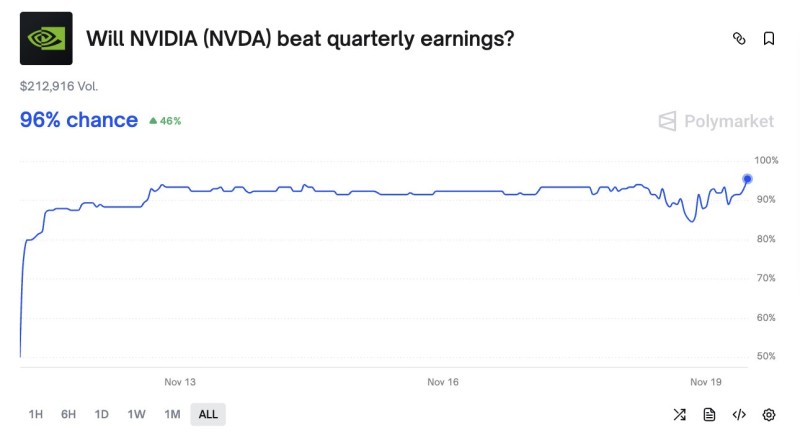

Traders estimate a 96% chance of an earnings beat, backed directly by Polymarket chart data. The numbers tell a clear story: 96% probability NVDA beats expectations, 46% jump in confidence levels, and $212,916 in total trading volume showing strong market participation.

The probability line has stayed near the top of the chart for the past week, rarely dropping below 90%.

Chart Shows Steady High Confidence With Little Movement

The Polymarket chart reveals a straightforward pattern. Right after the prediction window opened, probability shot up from lower levels straight into the 90–95% range and stayed there. From November 13 onward, the line remained almost flat, trading mostly between 92–96% with just one brief dip to the mid-80s before quickly recovering. In the final 24 hours, confidence pushed toward 96%, showing traders aren't backing down heading into the announcement.

Why Traders Think NVIDIA Will Deliver Another Strong Quarter

The overwhelming confidence comes from several clear drivers. AI demand remains explosive, with NVIDIA sitting at the center of global AI infrastructure—H100 GPU demand still outpaces supply, keeping order books full for quarters ahead. Data center momentum continues building as analysts keep raising revenue expectations for NVIDIA's largest and fastest-growing segment. The company's track record speaks volumes too: NVDA has beaten earnings estimates in nearly every quarter over the last two years, and prediction markets are clearly factoring that in. Add in sector tailwinds from rallying AI equities and semiconductor stocks heading into the report, and you've got broader market alignment with a positive outlook.

Market Impact Could Reach Beyond NVDA

If NVIDIA delivers another strong quarter, the effects could spread across semiconductor ETFs like SOXX and SMH, cloud infrastructure providers, AI software developers, and mega-cap tech companies with AI exposure. NVDA carries serious weight in the S&P 500 and Nasdaq 100, making its earnings influential for overall index direction.

High Conviction Sets Up Critical Report

The Polymarket data paints a clear picture: traders overwhelmingly expect NVIDIA to beat earnings, with confidence near the highest levels seen all year. That 96% reading suggests markets are already positioned for strength, but the real reaction will depend on guidance, AI demand commentary, and what management says about the road ahead. As the tech sector watches closely, NVIDIA's report is set to influence market sentiment for weeks to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith