NIO continues struggling with declining institutional support, as major investors have been steadily pulling back since 2022. This retreat coincides with a prolonged slide in the company's stock price, raising questions about whether the Chinese EV maker can reverse course without rekindling confidence among large funds.

Institutional Ownership Declines Further

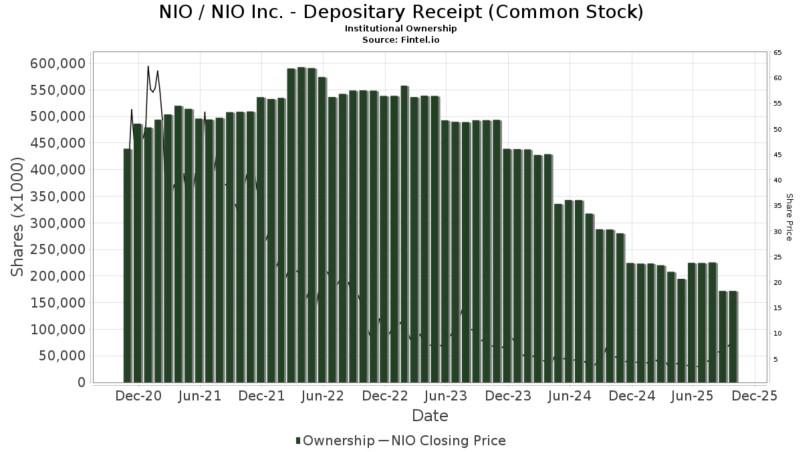

Recent data shows a pronounced downward trend in institutional holdings of NIO. As analyst Marcel Münch pointed out, large investors have been consistently cutting their exposure, reflecting waning confidence in the company's prospects.

This steady reduction mirrors the ongoing weakness in NIO's stock price, creating concerns about whether the automaker can regain traction without attracting institutional buyers back to the table.

Chart Analysis: Ownership and Price Dynamics

The visual data reveals a tight correlation between institutional holdings and share price performance. After hitting roughly 600 million shares in mid-2022, institutional ownership has dropped consistently. By late 2025, holdings fell below 200 million shares while NIO's stock traded near multi-year lows under $20 - a stark contrast to its 2021 peak above $60. The persistent decline suggests funds aren't just trimming positions but actively avoiding new purchases, leaving NIO more dependent on retail investors.

Why Investors Are Pulling Back

Several factors explain this retreat: intense competition from BYD, Tesla, and emerging EV rivals; ongoing profitability struggles as NIO pours resources into R&D while margins remain squeezed; macroeconomic challenges in China including softer demand and regulatory tightening; and broader geopolitical concerns making foreign funds more hesitant about Chinese stocks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis